Improve customer experience in banking

Use evidence-based decision-making to meet the current and emerging needs of your customers.

Data analytics can help you identify hidden opportunities, accelerate customer engagement, prioritize offers, influence digital adoption and identify at-risk members. Whether you are one of Canada’s Big Six, a direct bank or a fintech startup, we have the expertise to help you create customer-centric, scalable solutions for the rapidly changing financial services sector.

Enhance acquisition and your customer journey

Develop custom segments that leverage your brand equity and align with your strategic goals and objectives. Create rich personas to improve customer experience and increase engagement. Bolster acquisition efforts by locating prospective customers and identifying new markets most likely to respond to your value proposition.

Improve your engagement strategy and gain efficiencies

Use WealthScapes, our comprehensive database of financial behaviour, to model your customers’ potential value and prioritize resources. Predict next best products to accelerate your growth with new customers and proactively identify and engage at-risk customers.

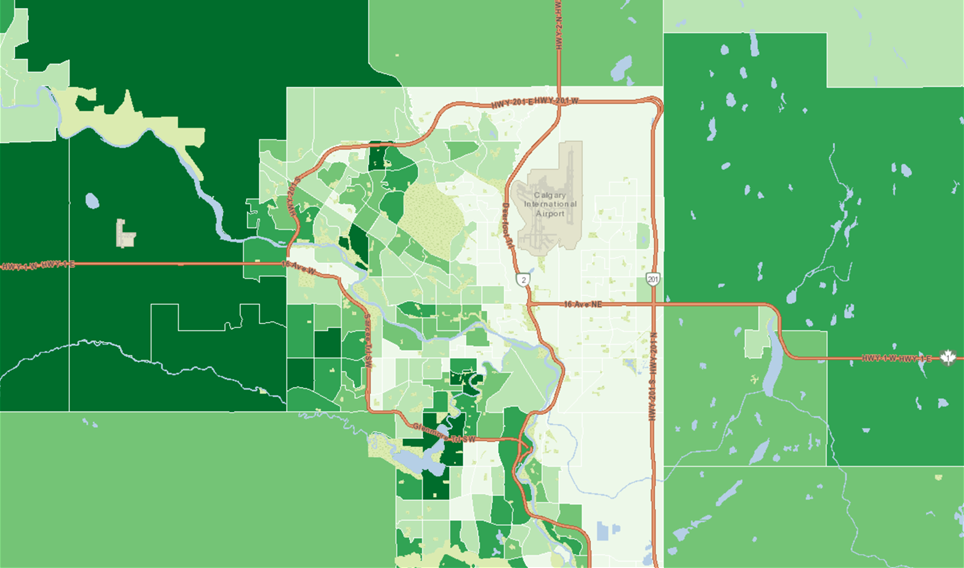

Optimize your network and channel strategy

Identify the drivers that influence adoption of web and mobile banking while optimizing your distribution strategy. Gain deeper insights into market potential to identify areas of opportunity and underserved markets. Analyze mobile movement data to understand visitor patterns at your branches and those of your competitors.

Want to know more about our Products and Services?

Get in touch. We're ready to help.

Meet our Financial Services Practice Team

Our consultants have the strategic expertise and sector experience to help address your key business challenges. Many of our clients work with us as a seamless extension of their team and think of us as their competitive advantage.

Larry Filler

Senior Vice President & Practice Leader

Larry Filler helps organizations realize value from data. He has more than 30 years of experience in developing and applying analytics solutions for clients across many industry sectors, including technology, financial services, retail, automotive, packaged goods, loyalty, travel and not-for-profit. Larry co-founded the Boire Filler Group, an analytics consulting practice that was acquired by Environics Analytics in 2016. He began his career at American Express and later worked at the Loyalty Management Group and MacLaren McCann Relationship Marketing. A frequent speaker at industry conferences, Larry holds a Bachelor of Science degree in Economics from the University of Wisconsin and an MBA in Marketing from Schulich School of Business at York University.

Michael Warner

Vice President, Business Development

Michael provides high-quality service and support for Environics Analytics’ applications and data products. With more than 20 years of experience, he has lead responsibility for helping banks and financial institutions implement their marketing programs and custom modelling solutions. Prior to joining Environics Analytics, Michael had a successful career at Canadian Imperial Bank of Canada (CIBC) managing numerous products with their retail and small banking division. Michael holds a Bachelor of Arts degree from Concordia University.

Who We Work With

Trusted by Leading Financial Brands and Organizations

Financial Services Industry Insights and Trends

Our industry experts publish timely analysis of government data releases, opinions on industry trends and insights on how organizations are embracing big data and analytics to help you stay informed.

For Whom the Rate Tolls

Implications of interest rate increases on discretionary spending.

Fintech Case Study: goeasy

See how goeasy leveraged data and analytics to better understand their customers and marketplace to evolve their business in times of change.

Industry Insights

Read about EA's recent mobile movement studies and insights from our industry experts.

We Know Data

Enhance your data with our privacy-compliant, authoritative databases. Choose from over 60 databases including financial, demographic, segmentation and behavioural data. Here are a few of our popular databases that support the needs of the financial services industry.

Custom Profiling & Segmentation

Create custom B2B segments, customer segments and economic segments aligned with your business goals and objectives.

WealthCare

Understand financial wellness by age to gain insight into the challenges and opportunities customers are likely to experience at different life stages.

WealthScapes

Canada's most comprehensive financial database for information on the assets, liabilities and income of Canadians and designed for financial planning, marketing and targeting applications.

.jpg?sfvrsn=e0eebd17_1)

.jpg?sfvrsn=f7722960_3)