Protect your most valuable assets with data analytics.

Build customer relationships and reduce cumulative organizational risk using data and analytics tools. Whether you want to enrich your internal data or build models to predict fraudulent behaviour, we have the expertise to help you create customer-centric, scalable solutions that engage customers, win prospects, improve operations and drive business results.

Accelerate acquisition with your best prospects

Profile your best prospects and enhance the online application process by understanding their lifestage and financial well being. Differentiate your marketing messaging based on lifestyle, attitudes and values. Improve ROI on your media spend by investing according to your customers’ media consumption habits and preferred marketing channels.

Build lifelong relationships with your customers

Deliver an exemplary customer experience by understanding your base. Develop rich personas, outline their needs and then efficiently invest resources to develop next best products, identify cross-sell opportunities and improve retention. Optimize digital channels and leverage data to incentivize behaviours through wellness and loss prevention programs.

Enhance models and accelerate risk assessment

Broaden your analytical capabilities by augmenting your internal data with market data. Build stronger pricing and risk models with data such as demographic trends, wealth indicators, health behaviour, vehicle ownership and neighbourhood crime rates. Understand the health and wellness of the community, gauge your risk in the marketplace, and reduce the incidence of fraudulent claims.

We Know Data

Enhance your data with our privacy compliant, authoritative databases. Choose from over 60 databases including financial, demographic, segmentation and behavioural data. Here are a few of our popular databases that support the needs of the insurance industry.

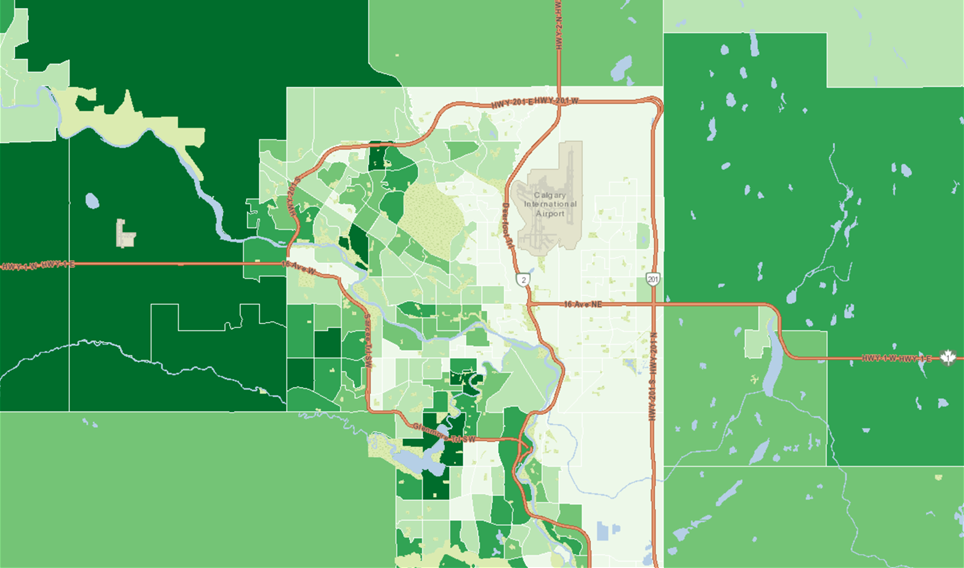

Segmentation - PRIZM®

PRIZM® segments Canada’s neighbourhoods into 67 unique lifestyle types and incorporates data from nearly a dozen demographic, marketing and media sources to help you better analyze and understand your insurance customers.

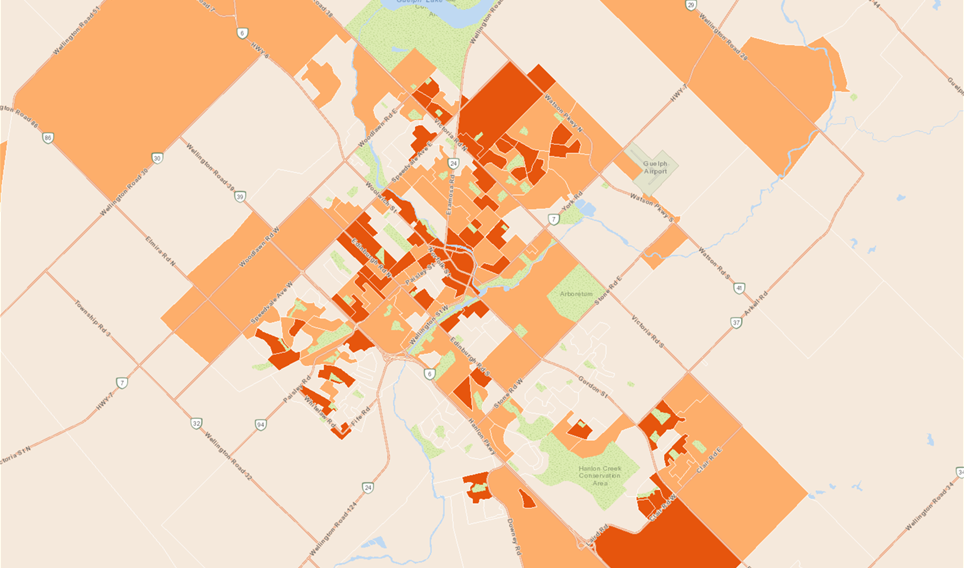

Financial - Wealthscapes

WealthScapes is Canada’s most comprehensive financial database. Built using authoritative data and sophisticated modelling techniques to quantify the assets and liabilities of Canadian households.

Demographics Databases

Track neighborhood growth patterns and forecast trends with demographic data covering gender, age, education, housing, cultural diversity, occupation, income levels and marital status across a wide range of census and geographic areas.

Financial - MoneyMatters

MoneyMatters Powered by Canadian Financial Monitor (CFM) is a major source of household financial characteristics in Canada. It provides users with competitive insights, channel preferences and financial behaviour at the postal code level.

Want to know more about our Products and Services?

Get in touch. We're ready to help.

Meet our Insurance Practice Team

Our consultants have the strategic expertise and sector experience to help address your key business challenges. Many of our clients work with us as a seamless extension of their team and think of us as their competitive advantage.

Larry Filler

Senior Vice President & Practice Leader

Larry Filler helps organizations realize value from data. He has more than 30 years of experience in developing and applying analytics solutions for clients across many industry sectors, including technology, financial services, retail, automotive, packaged goods, loyalty, travel and not-for-profit. Larry co-founded the Boire Filler Group, an analytics consulting practice that was acquired by Environics Analytics in 2016. He began his career at American Express and later worked at the Loyalty Management Group and MacLaren McCann Relationship Marketing. A frequent speaker at industry conferences, Larry holds a Bachelor of Science degree in Economics from the University of Wisconsin and an MBA in Marketing from Schulich School of Business at York University.

Why Us

We’ve got the expertise to help. With decades of leadership and experience in the industry, we are the only analytics firm in Canada to offer our broad range of privacy compliant, consumer and business databases, proprietary software and team of industry professionals.

Meeting the highest standards of data security

Insurance Industry Insights and Trends

Our industry experts publish timely analysis of government data releases, opinions on industry trends and insights on how organizations are embracing big data and analytics to help you stay informed.

For Whom the Rate Tolls

Implications of interest rate increases on discretionary spending.

Industry Insights

Find timely analysis from our industry experts and insights on how organizations are looking to mobile movement data and data analytics to inform recovery planning.

Join a Webinar

Register for upcoming webinars or view previous presentations and recordings.

PRIZM is a registered trademark of Claritas, LLC.

.jpg?sfvrsn=f7722960_3)

.jpg?sfvrsn=e0eebd17_1)