WealthScapes

The most comprehensive database covering the assets, liabilities and income of Canadians

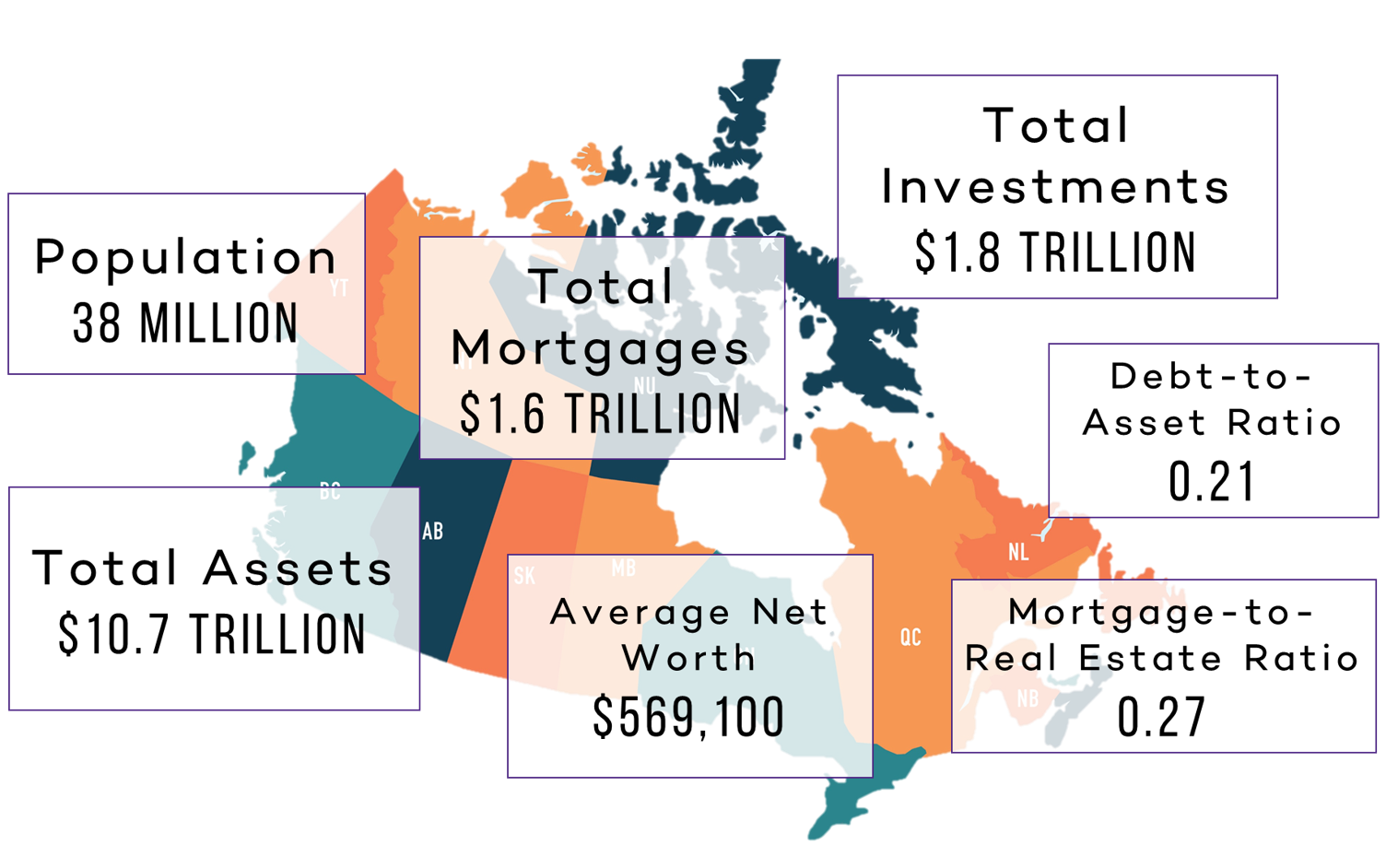

Built using authoritative data and sophisticated modelling techniques, WealthScapes is the most comprehensive database available for information on the assets, liabilities, net worth and income of Canadians. Designed for financial planning, marketing and targeting applications, the latest version features 108 key financial and investment statistics. A subset of approximately 23 summary-level financial variables are also available in WealthScapes Lite.

WealthScapes 2021 was completely rebuilt from the ground up to allow a more modular approach to integrating new data sources and adapt to current trends. For example, as Canadian investments continue to trend towards more retirement plans and tax-free savings options, RSPs have been replaced with detailed RRSP, RRIF, RESP variables.

In 2023, WealthScapes has been enhanced to provide better projections for several financial assets and debt. These methodological enhancements are particularly notable in the following: consumer debt, liquid assets including TFSAs, RRSPs and RRIFs, unlisted shares and pensions.

Score financial wellness

Gain a better understanding of the financial and investment behaviours of donors, prospects and customers

Key wealth statistics

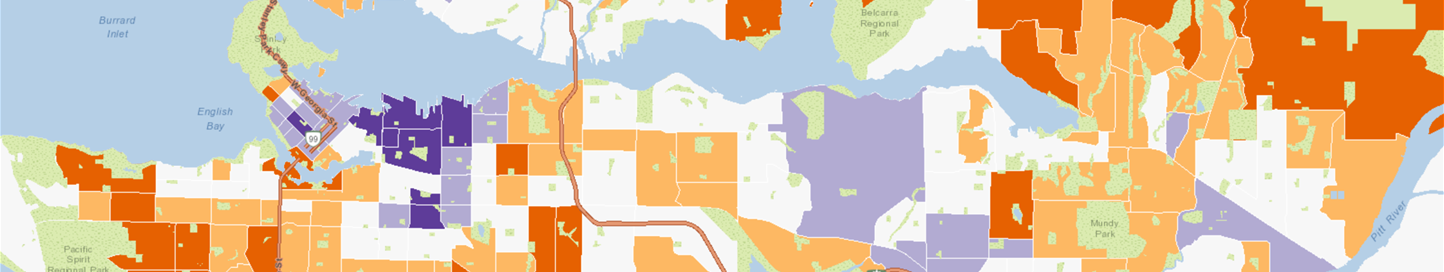

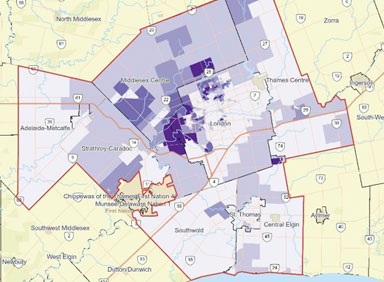

Understand the economic and financial status of Canadians at the postal code level

Gauge market and wallet share

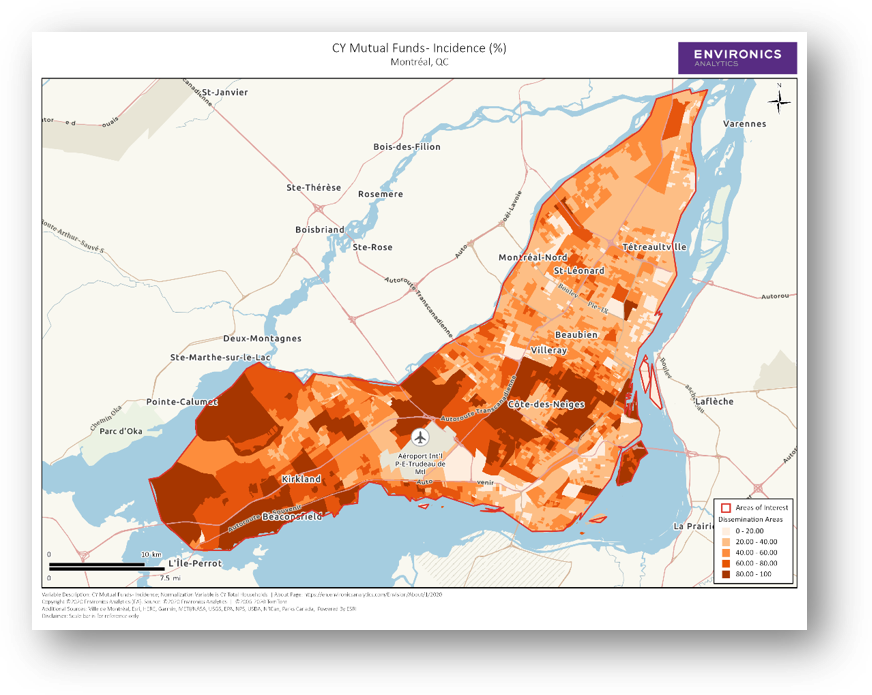

Make smarter marketing decisions when looking to promote and improve your financial products and services

Follow the money

WealthScapes helps financial institutions, charitable organizations and large retailers gain a better understanding of the financial and investment behaviours of their customers.

- Built using sophisticated modelling techniques and controlled with data from authoritative sources such as the Bank of Canada, Canada Revenue Agency, Ipsos, Teranet, Equifax and Statistics Canada

- Key variables used in WealthScapes are created to match the best available control totals in Canada so that they will be endorsed by the chief economists

- Features 108 key financial and investment statistics showing market share and share of wallet

- WealthScapes Lite offers a subset of 23 summary-level financial variables

Answer your most pressing questions about the financial wellbeing of Canadians

- What is the average net worth of households within my trade area?

- What is the difference between the total disposable income and discretionary income of the households in my trade area?

- What proportions of my customers’ assets are held in chequing and savings?

- Which areas within my trade area have a high debt-to-asset ratio?

- What types of debt do my customers have? Are their debts dominated by credit cards? Lines of credit? Mortgages?

- Are the average real estate values around my business higher or lower than the average for the broader community?

Find release notes, metadata and more information about how to use the WealthScapes database on our Community website.

Learn from our experts

Hear about current trends in the assets, liabilities and income of Canadians and find out why powerful insights generated from the WealthScapes database are an essential resource for any organization looking to gain a better understanding of the financial and investment behaviours of their market.

Financial data case studies

Financial institutions, charitable organizations and large retailers all use financial data for evidence-based decision making to improve marketing, guide high-level strategic planning and drive operational improvements.

These are a few examples of how we have helped our clients leverage financial data to gain a better understanding of the financial and investment behaviours of their customers.

Want to know more about our Financial databases?

We're here to help.

Industry Expertise

Discover how we can help you turn data, like WealthScapes, into insights, execution and results.

Banking

Increase acquisition and relevancy. Model your customers' potential value to prioritize your resources and customize your services to meet their individual needs.

Credit Unions

Engage your members and improve their financial wellness. Bolster acquisition efforts by locating prospective members and identifying new markets.

Insurance

Broaden your analytical capabilities by augmenting your internal data with market data and create rich personas to develop the next best products and improve retention.

Case Studies

Discover how we are helping organizations use data analytics for evidence-based decision making to improve marketing, guide their high-level strategic planning and drive operational improvements.

More Data to Choose From

Enhance your understanding of the financial behaviour of Canadians and develop a comprehensive picture of their assets, liabilities and net worth.

WealthTrends

A new and essential add-on for WealthScapes users to access quarterly updates to the economic and financial picture of Canadians at the neighbourhood level.

WealthScapes Fundraiser

Identify prospective donors that are likely to receive an inheritance and potentially a greater capacity to donate.

WealthScapes Daytime

75 variables to help users understand the demand for financial products and consumer spending power in an area during business hours.

WealthCare

Understand financial wellness by age to gain insight into the challenges and opportunities that customers are likely to experience at different life stages.

Environics Analytics Webinar Series

Register for upcoming webinars or access our past presentations.

Keep up to date on the latest trends and discover the latest advancements in our data and analytics services and product offerings.