Hunting Millennials: The Exotic Ice Cream Episode

Every week my clients ask how they can connect with Millennials. Today’s 16- to 35-year-old consumers are hot commodities that both retailers and manufacturers are eager to convert into shoppers and buyers. It is a logical question because they represent an increasingly important—and strategic—segment of Canadian consumers that no brand or retailer can afford to ignore.

So it comes as no surprise that this past summer, Haagen Dazs Canada announced it was focusing its marketing efforts on Millennials. The company is looking at this generation to fuel future growth and offset the eventual decline among Boomers and GenXers for Haagen Dazs products. Millennials will “be with the brand for the next 30, 40, 50 years,” Paul de Larzac, Marketing Director of Nestlé, told Strategy in July, and the math certainly supports that observation. But how should Haagen Dazs—or any brand, for that matter—integrate Millenials into their current and long-term plans?

Millennial Mindset

Looking at Millennials through the demographic and psychographic variables found in Demostats, Vividata and Environics Analytics’ SocialValues surveys, common themes appear that manufacturers like Haagen Dazs have tapped into. This is a social generation that wants to connect with people and share experiences. Status and image are important to them. They are the most diverse age cohort in Canada, consisting of 22 percent first or second generation immigrants to Canada and professing the nation’s most accepting attitudes regarding diversity of all kinds.

The opportunity for Haagen Dazs to grow sales among this generation is considerable. One-third of Millennials enjoy being extravagent and 51 percent want to try new products, according to SocialValues data. However, according to the Homescan Consumer Shopping Opinion Survey, Millennials are not as loyal as the Boomer generation, with 40 percent of Millennials claiming they will pass up a favourite brand if another is on sale compared to 33 percent of Boomers. While 69 percent of Millennials tend to find a brand and stick with it, for Boomers that number is 78 percent. Accordingly, manufacturers and retailers need to budget for constantly evolving marketing tactics to maintain the attention, and taste, of this more fickle group.

Do Millennials Buy Ice Cream?

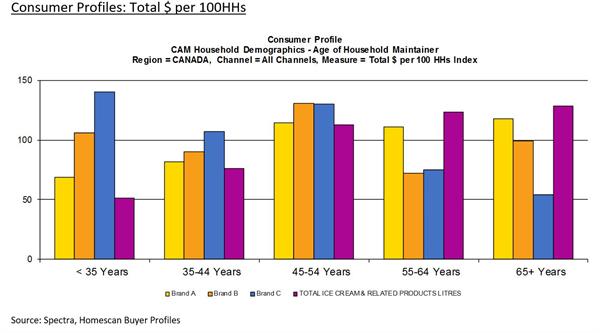

This is a fundamental question that helps structure any Millennial-focused engagement strategy. Are these consumers purchasing your product now or do you have to build a new framework to get them to add it to their shopping carts? Using the Homescan buyer profile from EA’s Spectra system, we can look at three premium ice cream brands among Millennials. Then we can analyze how each brand performs against the general ice cream category and against each other.

We can see that based on total dollars spent per 100 households (HHs), Brand A performs at a rate significantly below average (index 69) in the Millennial group. However, when it comes to Brand B, an extension of Brand A that features unexpected flavors and added chunks, Millennials spend an average amount (106). Looking only at Brand A’s overall performance, it is understandable why Brand A would be interested in increasing its efforts to create products with new flavour experiences and create marketing buzz: It wants to build on Millennials’ solid interest in the Brand B line and bring more Millennials into the category.

However, when we look at the performance of a competitor, Brand C, the story takes a turn. Millennials are buying premium ice cream, just not Brand A. Compared to total dollars spent per 100 HHs for Brand C (140), Brand A’s standard flavours underperform by 70 points while Brand B underperforms with a 34 point deficit. This substantial gap suggests that Brand A should switch its marketing strategy from one of introducing a category to Millennial buyers (since they obviously are already receptive to the premium category) to one that better aligns the brand and its value proposition to the tastes of the Millennial consumer. It should also target the Brand C buyer to change brands.

Who is the Consumer vs. the Shopper?

Contrary to the prevailing stereotype that there is no one “Millennial consumer,”this group is diverse and quickly moving through a number of evolving lifestages. Millennials range in age from 16 to 35 (born between 1981 and 2000). They include the “sexy, single and free” independent adults and couples who seem to be top-of-mind in popular culture. Young Millennial parents are at the opposite end of the spectrum of needs based on lifestage compared to Millennials who still live at home or are supported by mom and dad while at college or university.

Those Millennials with young children spend an above-average amount on Brand A products (index of 113), but they spend even more if their household income is greater than $75,000 (index 141) or they live in urban areas (135). Indices drop to significantly below-average levels for young families in less affluent towns (47) and rural areas (27). Independent, single Millennials (the ones who have left home) buy Brand A at below-average rates (index 69), regardless of income or location, but in urban areas, they buy twice the average amount of Brand C (255 index).

Those Millennials who are living with their parents are not necessarily making purchase decisions, as they are often not the person doing the shopping for the household. While social and online campaigns may catch their attention and build desire for a new product, the best outcome for marketers is to hope that their requests will influence the shopper in the home. When the parents come home from shopping, they are just as likely to say, “Honey, your ice cream was on sale and I bought you some” as “Honey, I saw a new flavour of your favourite brand and bought you some.” As a result, targeting those Millennials who still live at home also requires engaging the shopper in the house. That individual may not be as responsive to digital media as their Millennial children; they may need additional stimulus other than in-store marketing to fullfill the “want” by the Millennial member of the household.

Proceed with Caution

When, in Brand A’s case, 86 percent of volume comes from segments of the population who are not actively being targeted, and when 48 percent of the volume comes from generations who are not heavy digital or social media users, a marketer should proceed with a bit of caution. Building awareness and appetite with consumers is critical to generate enough interest and brand awareness so that retailers will carry the product. However, when it comes to point of sale, the first time a shopper experiences a new flavour or enhanced value proposition should not be through on-shelf messaging.

Consider stretching the digital and experiential strategy to find shoppers away from the store at online dating sites like Our Time, speed dating events for the single and newly single, and outdoor events like jazz and folk festivals. You can also find both Millennials and their parents at tasting booths at outdoor concert venues when classic rock bands from the ’70s or ’80s are playing. And they respond to branding tie-ins with televised cooking shows that have a YouTube presence. Finally, an omni-channel approach that blends digital and traditional media will help build appreciation by Millennials along with their parents of the brand proposition and increase the likelihood that the right product is going into their shopping basket.

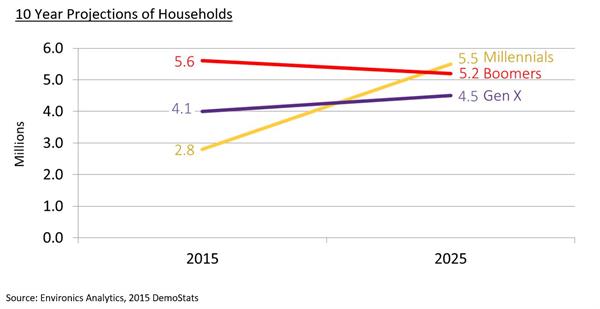

Looking forward at future Canadian Shoppers

Boomers and Gen Xers right now are larger than Millennials when it comes to household count. While the number of Boomer households will decrease and Gen X households will hold steady, the number of Millennial households will double, passing Boomers, in the next 10 years. The three groups will move closer together for a period of time with only 300,000 households separating Boomers and Millennials.

It’s worth celebrating the targeting of Millennials in order to grow the sales funnel, expand sales, grow product lines and stimulate innovation. And it is exciting to generate new revenue streams and incorporate new technology and cool experiential activities into your toolkit.

But I caution marketers to not forget about the older, foundation consumers who have been instrumental in building their brands over the years. They represent 9.7 million households today as well as in 10 years. Going fully digital, social, or experiential with your marketing spend is sexy and may be less expensive up front. But consumers who are left with only in-store and in-flyer promotional engagement will be more likely to lose interest, perhaps swept up by a savvy competitor or, worse yet for the whole category, begin to “chase the bottom” as they change from a loyal buyer to one who buys only on promotion.

Andrea Longman is a Senior Client Advocate with the packaged goods, automotive, public sector and not-for-profit practice.

Andrea Longman is a Senior Client Advocate with the packaged goods, automotive, public sector and not-for-profit practice.