Banking

Improve customer experience in banking

Use evidence-based decision making to meet the emerging needs of your customers. Data analytics can help you identify hidden opportunities, accelerate customer engagement, prioritize offers, influence digital adoption and identify at-risk customers. Whether you are a national, regional or community bank, we have the expertise to help you create customer-centric, scalable solutions for the rapidly changing financial services sector.

Enhance acquisition and the customer journey

Develop custom segments that leverage your brand equity and align with your strategic goals and objectives. Create rich personas to improve customer experience and increase engagement. Bolster acquisition efforts by locating prospective customers and identifying new markets most likely to respond to your value proposition.

Improve your engagement strategy and gain efficiencies

Model your customers' potential value to prioritize your resources and customize your services and meet their individual needs. Predict the next best offer to find new revenue streams and proactively identify and engage at-risk customers.

Optimize your network and channel strategy

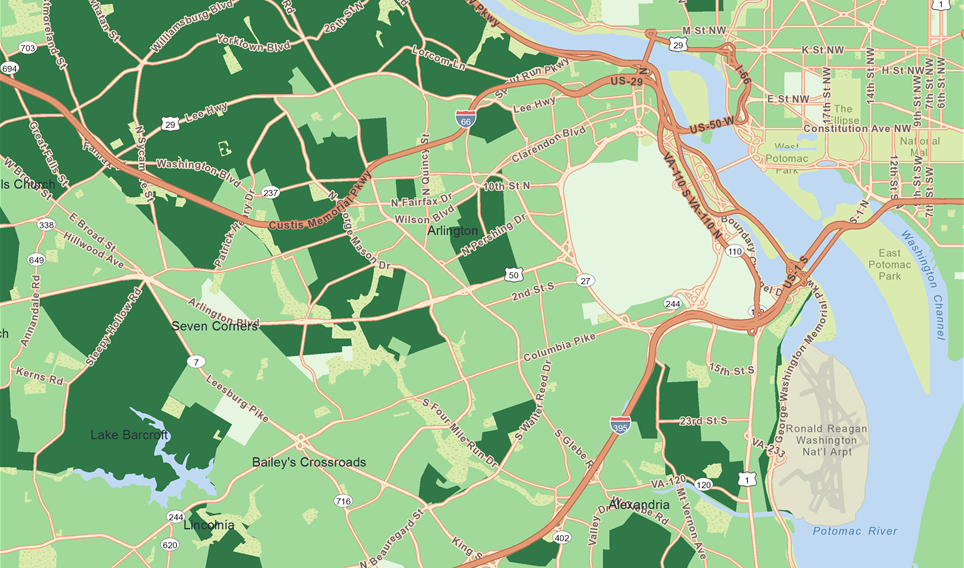

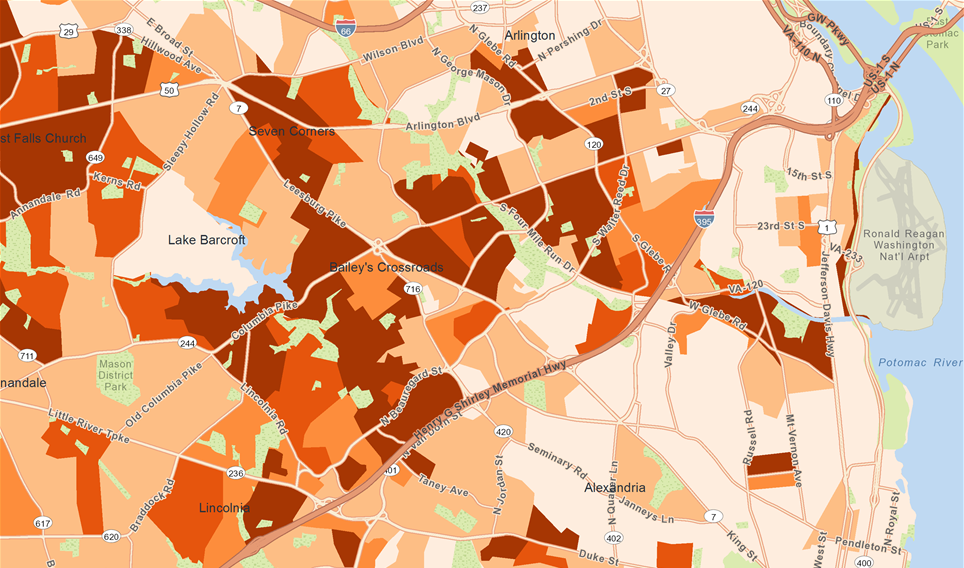

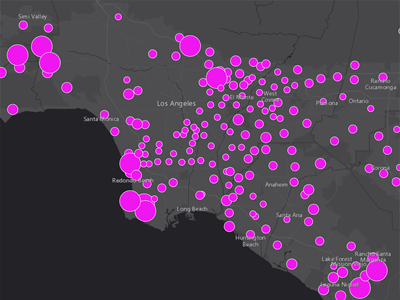

Identify the drivers that influence the adoption of web and mobile banking while optimizing your distribution strategy. Gain deeper insights into the market potential to identify areas of opportunity and underserved markets. Analyze mobility data to understand visitor patterns at your branches and those of your competitors.

Financial Services Expertise

Our consultants have the strategic expertise and sector experience to help address your key business challenges. Many of our clients work with us as a seamless extension of their team and think of us as their competitive advantage.

Meet Sean Moloney

Senior Vice President and Practice Leader

As Senior Vice President & Practice Leader, Sean Moloney leads our business development and sales practice in the United States. With over twenty-five years of experience in the marketing analytics industry, Sean helps organizations turn data and analytics into insight, which becomes the foundation for an effective strategy. In his role, Sean leverages his extensive knowledge of geodemographics, segmentation, and advanced analytics to help clients combine different data types with business analytics tools and techniques to deliver results. Before joining Environics Analytics, Sean held analytics, sales executive and national account manager roles at Pitney Bowes Software, MapInfo and Compusearch. Sean earned a Bachelor of Applied Arts in Applied Geography degree from Ryerson University.

Want to know more about our Products and Services?

Get in touch. We're ready to help.

We Know Data

Enhance your store data with our privacy compliant, authoritative databases. Choose from over 30 databases including financial, demographic, segmentation and behavioral data. Here are a few of our popular databases that support the needs of the financial services industry.

Claritas Financial CLOUT® contains current-year and five-year projections of market penetration and dollar balances for more than 100 financial products including checking accounts, investments, credit cards, lines of credit and savings products.

Create a comprehensive picture of your customers according to shared demographic, lifestyle and behavioral traits. Discover where they live and understand their preferences to create more effective marketing strategies.

Track neighborhood growth patterns and forecast trends with demographic data covering gender, age, education, housing, cultural diversity, occupation, income levels and marital status. Data available across a wide range of census and geographic areas.

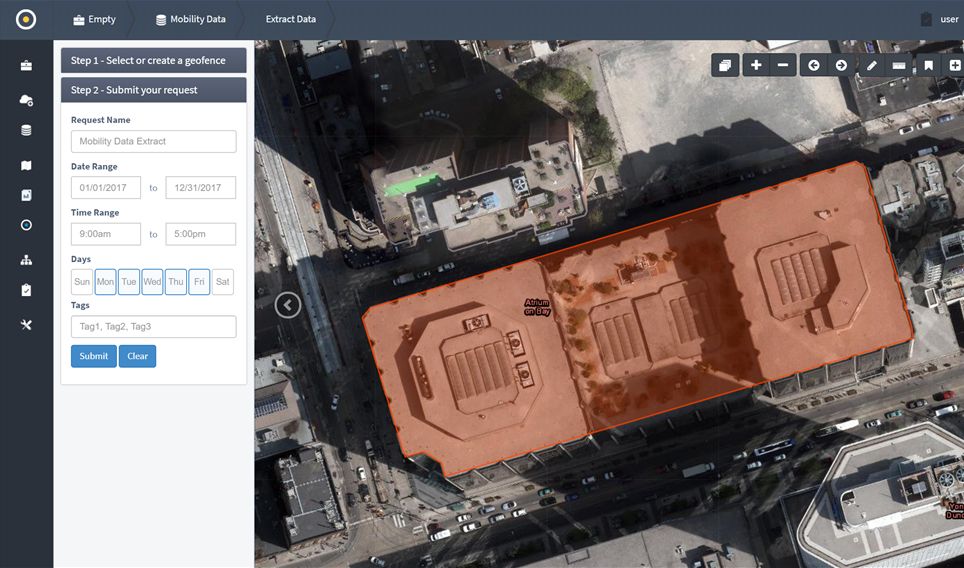

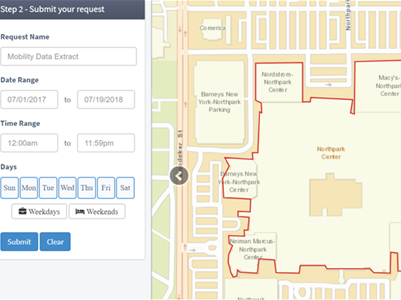

Enhance what you know about who walks into a branch or may have witnessed strategically placed outdoor advertising. Mobile data can be instrumental in site selection by identifying areas of higher potential value based on visitor patterns.

Frequently Asked Questions

We pride ourselves on our ability to collaborative with your internal teams and external partners. At Environics Analytics, you'll get access to a broad range of data scientists, mathematicians, statisticians, geographers, developers and business and marketing strategists. With hundreds of years of cumulative experience, we're skilled in uncovering insights using analytics tools such as custom segmentation, predictive modeling and location intelligence. We also offer more than 30 databases containing over 20,000 variables enabling you to augment your data with market data for enhanced analysis.

If your organization is in the early stages of your analytics journey, we can provide training and support for your team and help you build a business case for bringing the tools and expertise needed for continuous analysis in-house. For many of our clients, our team does the work their internal teams don’t have the capacity or experience to complete. You'll find our approach extremely collaborative and flexible so we can provide you with solutions that scale easily to your needs and budget.

It is not uncommon for banks to conduct research on their customers or develop segments internally or through a third party. We have worked with many banks to help them take their strategic research segments and make them actionable at small area level. This helps link your strategy to your branches, marketing initiatives and regional tactics. For example, we can help you target millennials or the mass affluent population.

Many financial institutions have clean and accessible datasets on their current customers. However, this data is often limited to their current financial relationship with your organization and some pertinent demographic data collected as part of a product application. Augmenting your data with market data can help create a more robust picture of who your customers are and their needs. We offer a wealth of market data on financial preferences with your bank and your competitors including: digital behavior, psychographics, ethnicity and other demographic data not typically collected. Since this data is available at the zip code level, it can also help inform acquisition strategies with people who are not yet your customers and provide insight on how to better attract them to your brand. See databases

Absolutely. We are highly skilled at building analytical files that combine data from disparate sources. If you can provide us with a way to link customer data across different tables, we can do the rest.

Congratulations on wanting to foster a data-driven culture. The analytics journey starts with finding the right executive sponsor to support the cultural shift, understanding the data needs across all departments and levels of the organization and then building an analytics roadmap. Our team is highly skilled at helping you connect key stakeholders and develop a strong business plan, including aligning your data and analytics strategy to your business goals, creating an implementation plan and developing success metrics. Get in touch to discuss how we can help you kick-start your analytics journey. Contact us

We take privacy, compliance, and data governance very seriously, and we are very proud of receiving favorable SSAE CSAE 3416 SOC1 Type II ,SOC2 Type II, and HIPAA/HITECT audit reports after rigorous, independent reviews of our internal security controls. The reports represent certification with programs such as CSAE 3416 (Canadian Standard on Assurance Engagements (CSAE) 3416), AICPA (American Institute of Certified Public Accountants) and HIPAA-HITECH.

In addition, the source data used as inputs to our product development are 100 percent privacy compliant. Any personal information provided to us by clients is used solely for the purposes of their business and is safeguarded in client-specific, firewalled locations in secured data centers. We also ensure that our compliance policies for Canada and the U.S. are consistent with the E.U.'s General Data Protection Regulation (GDPR). See our databases

Mobile analytics can enhance what you know about who attends sporting events, festivals, charity races, gallery openings etc. It can be instrumental in determining if sponsorship initiatives are aligned with your target market.

MobileScapes is an anonymized, permission-based data service, which uses data collected from location-enabled devices that were observed within a geofenced area defined by latitude and longitude. Our mobility data is collected only if consent or permission is provided by the individual. See MobileScapes

We have experience working with our clients to develop testing and measurement plans to assess the success of your segmentation, modeling, campaigns.

Why Choose Environics

We've got the expertise to help. With decades of leadership and experience in the industry, we are the only analytics firm in Canada to offer our broad range of privacy compliant, consumer and business databases, proprietary software and team of industry professionals.

Company Statistics

Awards and Recognition

Meeting the highest standards of data privacy and security

Financial Services Industry Insights and Trends

Our industry experts publish timely analysis of government data releases, opinions on industry trends and insights on how organizations are embracing big data and analytics to help you stay informed.

How the data-rich financial sector can benefit from mobile analytics.