Mobile Analytics

Mobile Analytics

Mobile movement data, updated daily

Mobile analytics help businesses and organizations enhance what they know about consumer and citizen movement patterns using privacy-compliant mobile movement data collected from location-enabled mobile devices.

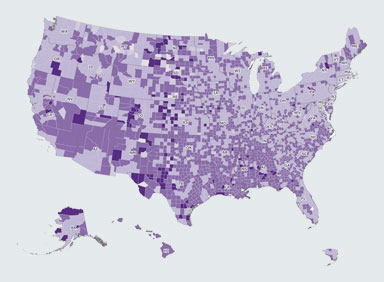

MobileScapes is the most accurate, comprehensive and up-to-date mobile movement database available for marketing and business applications. It is developed from permission-based data collected by our trusted suppliers, using location-enabled apps. The data are de-identified by our suppliers before they are sent to Environics Analytics and then modelled using the best spatial data processing and analysis practices. Data is available at the ZIP+4 level and can be linked to EA’s 20,000 data points including demographic, lifestyle, social values and spending information from our PRIZM Premier segmentation system, which makes it possible to develop detailed profiles of consumers in any trade area or location whether you have customer data or not.

Use MobileScapes to learn about locations visited or competitor locations, how often, and where they live and work to inform decisions around products, program development, marketing, messaging, recovery planning and staffing levels.

Access via EA’s analytics platforms or as data extract files and in project work

Updated daily to better understand the movement patterns of Americans

High-quality and anonymized sourced from de-identified permission-based data

Need mobile movement data to inform your recovery strategy?

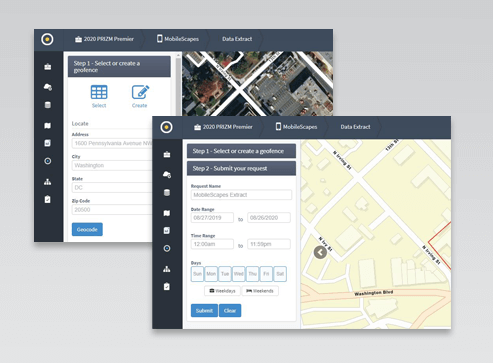

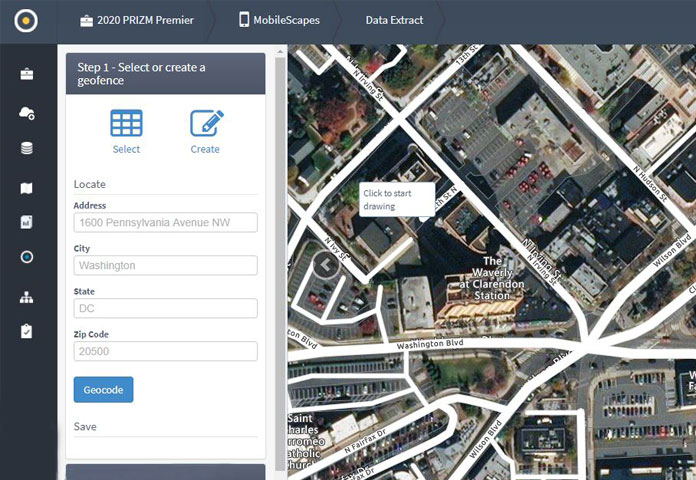

MobileScapes ENVISION

Now ENVISION users can quickly analyze large volumes of mobile movement data by location using hand-drawn polygons or existing location files. Easily connect mobile movement data to EA's 20,000 data points to derive key insights and link to dashboards and custom reports.

Mobile Movement Data and Recovery Planning

Connecting mobile movement data with traditional data provides incremental and actionable insights on consumers and citizens – their movement patterns, where they live, shop and play, as well as where and how to connect with them.

About the MobileScapes Database

Accurate, anonymized and privacy-compliant mobile movement data accessible by MobileScapes ENVISION or via project work.

- Updated daily

- Available at the ZIP+4 level and linked to EA's 20,000 data points

- Easily accessible through EA’s analytics platforms and as data extract files and in project work

- Integrate mobile movement data with EA's PRIZM Premier segmentation system to develop detailed profiles of consumers in any trade area or location whether you have customer data or not

For release notes and more information, visit our community site.

Answer Important Sector-Specific Questions, Quickly

Government: Which groups of residents are starting to frequent local businesses? Or use public transportation?

Retail: How quickly are different parts of the population heading back to bricks-and-mortar locations? How do changing shopper patterns impact staffing and store hours?

Financial: Are the same segments coming back to branches as during pre-pandemic times? Which audiences are a priority for additional online services?

Grocery and CPG: How have shopper patterns changed pre- and post-pandemic? How can this help with sales forecasting?

Travel and tourism: How do visitor volumes to a region compare to the same time last year? Who is most likely to come back?

Webinar - Next-Gen Mobile Movement Data: How EA's MobileScapes is Changing the Game

For the first time anywhere, EA’s data scientists have successfully combined SDK data (from GPS enabled in apps) with location data from the cellular network to estimate people’s movement. This improves the accuracy in trending analysis, expanding the number of observations by over 20 times and offers a more accurate view of what the different types of consumers are and where they are going.

Learn how SDK data and cellular network data work together to bring better coverage and representativity, and discover reports that deliver more enhanced seasonal trends and insights on customers and visitors.

Ready to really understand your customers?

Connect your data to mobile movement data

Mobile Analytics FAQs

Mobile analytics help businesses and organizations enhance what they know about consumer and citizen movement patterns using privacy-compliant mobile movement data collected from location-enabled mobile devices.

Mobile movement data are anonymized and permission-based data collected from location-enabled apps on mobile devices. The main sources of these data are opt-in location-enabled applications on mobile devices and ad exchange platforms. At present, there are approximately 100,000 mobile applications that contribute data to our MobileScapes services. Raw mobile movement data, at its most basic level, provides a unique and persistent, yet anonymous, device ID, along with a date, time, and latitude/ longitude coordinates for each observation. We then take steps to ensure privacy such as summarizing the data to periods of time. All observed latitude and longitude coordinates are moved to the nearest ZIP+4 to ensure anonymity.

Researchers can then observe device IDs within a defined area such as a store, public square or on a roadway for a given date and time range. Common evening location (CEL) and common daytime location (CDL) are inferred according to where these devices are most frequently observed during the day and at night. When analyzed correctly, mobile movement data can help you understand who’s visiting your locations, where your customers are coming from, how often they return and where else they might be going.

- Build Enhanced Customer Profiles: Easily link mobile movement data back to smaller area data and PRIZM Premier segments to get a clearer picture of your target market.

- Analyze Consumer Traffic: Identify the changing patterns in consumer visits to your location week-over-week and versus the same period last year.

- Gain Competitive Insights: Understand the visitor profile for nearby competitors and how their trade areas interact with your own.

- Improve Retail Site Selection: Pinpoint where your most frequent visitors are coming from to identify expansion opportunities and focus your local marketing efforts.

- Validate Sponsorship Opportunities: Determine if your sponsorship initiatives are aligned with your target market.

- Measure Brand Visibility: Profile consumers who have visited your locations or been exposed to your outdoor advertising.

The data are updated daily.

Yes. You can easily connect mobile movement data to EA’s traditional databases or your existing market and customer analysis for a more granular understanding of US movement patterns, behaviors and preferences.

ENVISION users can link mobile movement data to EA data points including demographic, lifestyle and spending information from the PRIZM Premier segmentation system to develop detailed profiles of consumers in any trade area or location whether you have customer data or not.

Yes. Our mobile movement data are collected only if the individual provides consent or permission. Consumers can easily change their level of location sharing overall or for individual mobile apps via their privacy settings on their mobile devices. Depending on the individual app settings, device holders can decide if a particular app should share their location while in use or block that permission outright. We actively participate in industry and association conversations in these areas, creating policies that protect individuals and allow for the responsible use of data.

To learn more about our privacy efforts, read our privacy policy.

Privacy Compliant Mobile Movement Data

The MobileScapes database represents privacy-compliant and anonymized mobile movement data collected by our trusted suppliers from permission-based apps that are location-enabled on mobile devices.

Environics Analytics is committed to protecting consumer privacy and data security in all respects, including our use of mobile movement data. We actively participate in industry and association conversations in these areas, creating policies that protect individuals and allow for the responsible use of data. For more information, see our privacy policy.