Insurance

Protect your most valuable assets with data analytics.

Build customer relationships and reduce cumulative organizational risk using data and analytics tools. Whether you want to enrich your internal data or build models to predict fraudulent behavior, we have the expertise to help you create customer-centric, scalable solutions that engage customers, win prospects, improve operations and drive business results.

Accelerate acquisition with your best prospects

Profile your best prospects and enhance the online application process by understanding their lifestage and financial well being. Differentiate your marketing messaging based on lifestyle, attitudes and values. Improve ROI on your media spend by investing according to your customers’ media consumption habits and preferred marketing channels.

Build lifelong relationships with your customers

Deliver an exemplary customer experience by understanding your base. Develop rich personas, outline their needs and then efficiently invest resources to develop next best products, identify cross-sell opportunities and improve retention. Optimize digital channels and leverage data to incentivize behaviors through wellness and loss prevention programs.

Enhance models and accelerate risk assessment

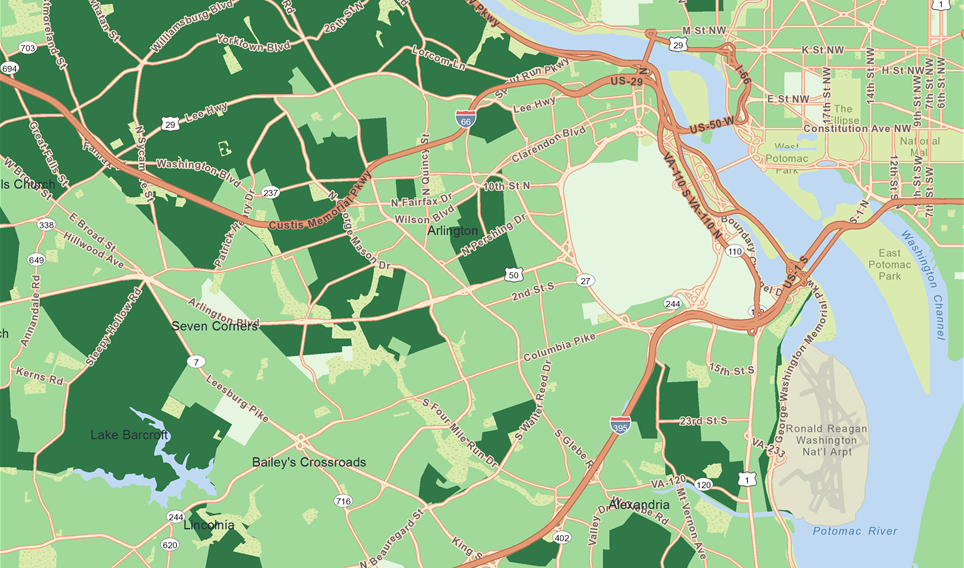

Broaden your analytical capabilities by augmenting your internal data with market data. Build stronger pricing and risk models with data such as demographic trends, wealth indicators, health behavior, vehicle ownership and neighborhood crime rates. Understand the health and wellness of the community, gauge your risk in the marketplace, and reduce the incidence of fraudulent claims.

Insurance Sector Expertise

Our consultants have the strategic expertise and sector experience to help address your key business challenges. Many of our clients work with us as a seamless extension of their team and think of us as their competitive advantage.

Meet Sean Moloney

Senior Vice President and Practice Leader

As Senior Vice President & Practice Leader, Sean Moloney leads our business development and sales practice in the United States. With over twenty-five years of experience in the marketing analytics industry, Sean helps organizations turn data and analytics into insight, which becomes the foundation for an effective strategy. In his role, Sean leverages his extensive knowledge of geodemographics, segmentation, and advanced analytics to help clients combine different data types with business analytics tools and techniques to deliver results. Before joining Environics Analytics, Sean held analytics, sales executive and national account manager roles at Pitney Bowes Software, MapInfo and Compusearch. Sean earned a Bachelor of Applied Arts in Applied Geography degree from Ryerson University.

Want to know more about our Products and Services?

Get in touch. We're ready to help.

We Know Data

Enhance your data with our privacy compliant, authoritative databases. Choose from over 45 databases including financial, demographic, segmentation and behavioural data. Here are a few of our popular databases that support the needs of the insurance industry.

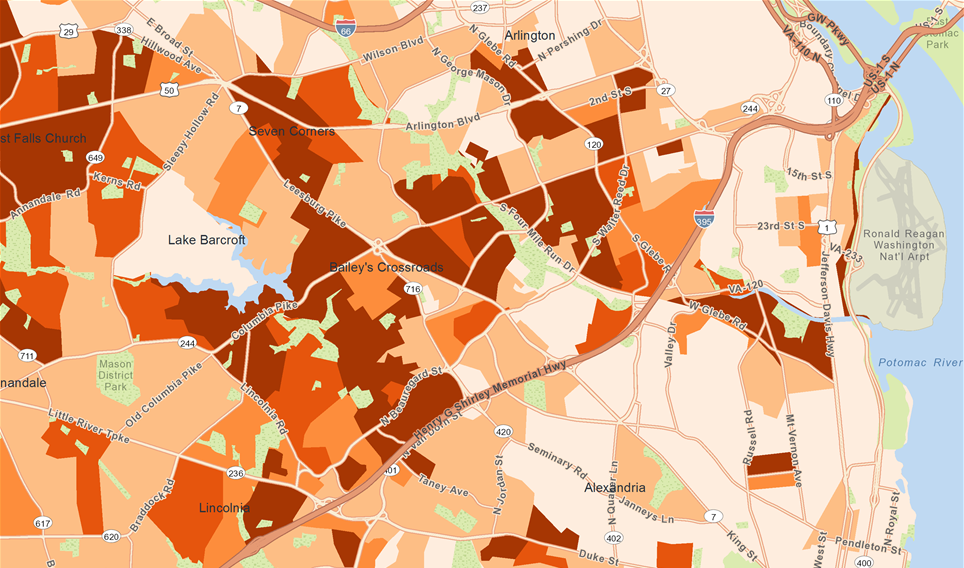

Create a comprehensive picture of your customers according to shared demographic, lifestyle and behavioral traits. Discover where they live and understand their preferences to create more effective marketing strategies.

Claritas Insurance CLOUT® includes current-year estimates and five-year projections of usage and demand for insurance products and services such as automobile, life, medical, residential, disability and long-term care policies.

Track neighborhood growth patterns and forecast trends with demographic data covering gender, age, education, housing, cultural diversity, occupation, income levels and marital status. Data available across a wide range of census and geographic areas.

Claritas Insurance Product Profiles provides users with powerful insights into their customers’ insurance behavior and attitudes towards insurance products and services, including types, number and value of policies owned and used.

Frequently Asked Questions

At Environics Analytics, we pride ourselves on our ability to collaborative and work with your internal and external partners. For many of our clients, our team does the work their internal teams don’t have the capacity or experience to complete. You’ll get access to a broad range of data scientists, mathematicians, statisticians, geographers, developers and business and marketing strategists who have industry experience and sector depth. With hundreds of years of cumulative experience, we're skilled in uncovering insights through segmentation, predictive modeling and site location intelligence. Our approach is extremely collaborative and you’ll find that we provide flexible solutions that scale easily to fit your needs.

Many insurance companies have clean and accessible datasets on their current customers. However, this data is often limited to their current relationship with your organization and some pertinent demographic data collected as part of the application process. Augmenting your data with market data can help you create a more robust picture of who your customers are, who they could be and what their needs are.

We offer a wealth of market data available down to the zip code level. This can help inform acquisition strategies with people who are not yet your customers and provide insight on how to better attract them to your brand. For example, we can help you target millennials or the mass affluent population. See our databases

We offer over 30 privacy-compliant databases. These databases help inform organizations on customer demographics, attitudes and lifestyle such as: financial behavior, neighborhood trends, channel preference, ethnicity and other demographic data not typically collected. See our databases

We take privacy, compliance, and data governance very seriously, and we are very proud of receiving favorable SSAE CSAE 3416 SOC1 Type II ,SOC2 Type II, and HIPAA/HITECT audit reports after rigorous, independent reviews of our internal security controls. The reports represent certification with programs such as CSAE 3416 (Canadian Standard on Assurance Engagements (CSAE) 3416), AICPA (American Institute of Certified Public Accountants) and HIPAA-HITECH.

In addition, the source data used as inputs to our product development are 100 percent privacy compliant. Any personal information provided to us by clients is used solely for the purposes of their business and is safeguarded in client-specific, firewalled locations in secured data centers. We also ensure that our compliance policies for Canada and the U.S. are consistent with the E.U.'s General Data Protection Regulation (GDPR). See our databases

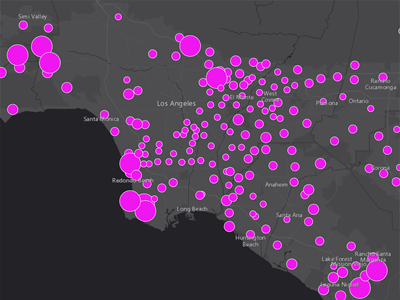

Mobility analytics can enhance what you know about who attends sporting events, music festivals, charity races, etc. It can be instrumental in determining if sponsorship initiatives and experiential events are aligned with your target market.

Mobility data is an anonymized, permission-based data service, which uses data collected from location-enabled devices that were observed within a geofenced area defined by latitude and longitude. Our mobility data is collected only if consent or permission is provided by the individual. See Mobility Analytics

Why Choose Environics

We've got the expertise to help. With decades of leadership and experience in the industry, we are the only analytics firm in Canada to offer our broad range of privacy compliant, consumer and business databases, proprietary software and team of industry professionals.

Company Statistics

Awards and Recognition

Meeting the highest standards of data privacy and security

Insurance Industry Insights and Trends

Our industry experts publish timely analysis of government data releases, opinions on industry trends and insights on how organizations are embracing big data and analytics to help you stay informed.

Implications of interest rate increases on discretionary spending.

How the data-rich financial sector can benefit from mobile analytics.

PRIZM is a registered trademark of Claritas, LLC.