Analytics Solutions for Banks and Credit Unions During COVID-19

Banks, credit unions and other financial institutions (FIs) are in a unique position to advise and assist current and potential customers through these uncertain times.

A mind-boggling 5.2 million Americans filed new claims for unemployment benefits in the week ending April 11, bringing the two-week total to 22 million. That’s more than the combined populations of Los Angeles and Chicago.

Unfortunately, this may just be the start to an increasing trend in unemployment rates.

In this blog, we’ll talk about some of the ways FIs can leverage data insights and analytics solutions to uncover areas where customers are most likely to be impacted by the current situation.

Identify local areas with larger concentrations of financially vulnerable households

Households reliant on income from industries like food service are some of the most impacted, resulting in the need to assess their financial situation over the next few weeks or even months. Using demographic data at a small area level, we identified local areas with workforce population that is more or less impacted by mandatory closures.

Using the Chicagoland market as an example, marketers can quickly identify geographic pockets most impacted by loss of employment in food services.

Chicagoland Map - % of Population 16+ Employed in Food Services

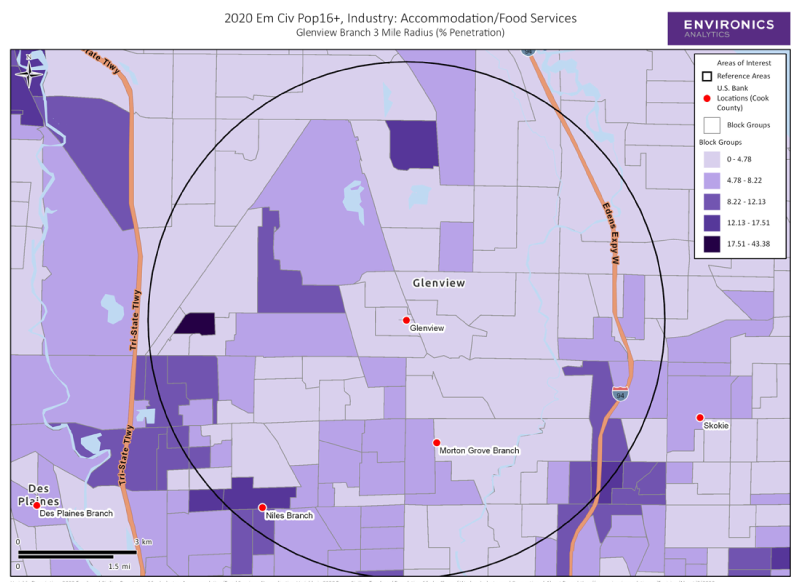

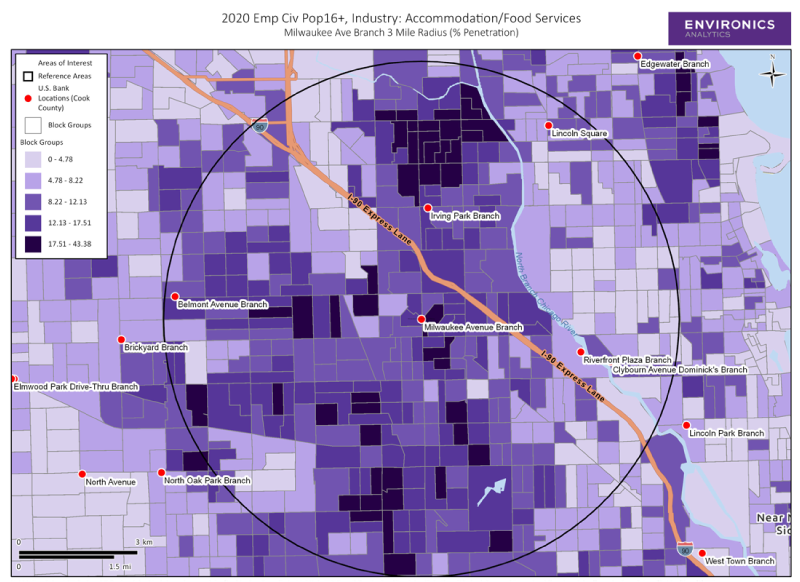

Taking it one step further we can identify local communities where our branches exist that may be more or less exposed to this population. The area within 3 miles of the Glenview branch has almost 3,000 people employed in food services while the Milwaukee Ave. branch is quite the opposite with over 30,000 or 11% of the population employed in similar services. There may be opportunities for the branch to tackle this obvious pain point head-on. These types of insights can quickly help focus financial institutions on the local markets most impacted in order to focus their outreach efforts to the communities in greatest need.

Table 1: Food Service Occupation Surrounding Chicagoland Branches

Branches in the Chicagoland area with higher or lower counts of people employed in food services.

Glenview Branch Map - % of Population 16+ Employed in Food Services within a 3 Mile Radius

Milwaukee Avenue Branch Map - % of Population 16+ Employed in Food Services within a 3 Mile Radius

Where should Financial Institutions be focusing their outreach efforts?

Many financial institutions have already implemented relief programs like relaxed withdrawal fees and loan payment deferrals for those in need, but there are opportunities for FIs to expand their efforts, using data analytics and insights, to proactively help local communities and the most vulnerable. Solutions like segmentation can be a powerful tool to help tailor communications to the right populations, with the right message, through the right channels.

Using data to assess local impact and drive community level strategies

Though it is unclear what the upcoming weeks and months will look like, currently there is a growing percentage of the population that may be feeling the strain on their wallets. Banks, credit unions and other financial institutions are in a unique position to advise and assist current and potential customers.

The example above is one of the many ways EA can help financial institutions deepen the understanding of their customers during this difficult time. By overlaying other data such as financial behaviors, other demographic characteristics, values and attitudes and spending habits, to name a few, to inform messaging, offers, and other outreach activities that would resonate with these communities.

--------

Environics Analytics (EA) is open for business and here to help. During these challenging market conditions, analytic solutions for banks, credit unions and FIs it has never been more important. Claritas P$YCLE Premier is a segmentation system that classifies consumers into one of 60 segments based on a wide variety of financial and investment behaviors. Financial institutions can help uncover the financial pain points that sub-segments of the population may be experiencing (or not), and in turn send the right message to the right consumers through the right channel.

If you have questions or would like to better understand how EA can help banks, credit unions and financial institutions, get in touch.