Retail is Re-Opening — Who Will Come…and How Fast?

“Is it ok to go shopping again?”

As states start to relaunch their local economies, retailers and consumers are asking this very question. For retailers in the position to re-open, a deep understanding of customer behaviors and preferences is essential given that many well-loved retailers have filed for bankruptcy and U.S. jobless claims have passed 40 million. Consumer sentiment research suggests that while regulations may be lifted, many consumers are not comfortable immersing themselves into the day-to-day activities that they were previously engaged in. Hard-hit retailers have a lot on the line. It stands to reason that they need to look to data and analytics to inform their re-opening strategy and answer common questions like:

- Which markets will see consumers coming back to bricks and mortar fastest?

- Which consumers will come out and shop and who will show more reluctance?

- When I open stores, which locations are more likely to drive growth?

We need data to understand what re-opening the retail sector looks like

There are several databases available to help retailers answer questions about re-opening brick and mortar locations. Mobile movement data can provide week-over-week insights about which populations are staying home and which are out-and-about. Knowing what retail trade areas have more consumers on the move or out-and-about can help to inform decision making about what stores to invest in, staffing, marketing priorities and lease negotiations with landlords to name a few, especially if current behavior is benchmarked against how consumers behaved last year.

Demographic, shopping behavior and psychographic databases can help to generate valuable customer insights about the populations identified with mobile movement data. In turn, retailers can use this information to determine where to focus local marketing and digital efforts to drive in-store traffic, as well as buy online and pick up in-store services.

To demonstrate the value of mobile movement data in combination with other data sources, we examined anonymized privacy-compliant mobile movement data for two malls in Houston, Texas to understand who was going out to the malls and who was staying home.

Mobile Movement Data – Visits to Almeda Mall and West Oaks Mall

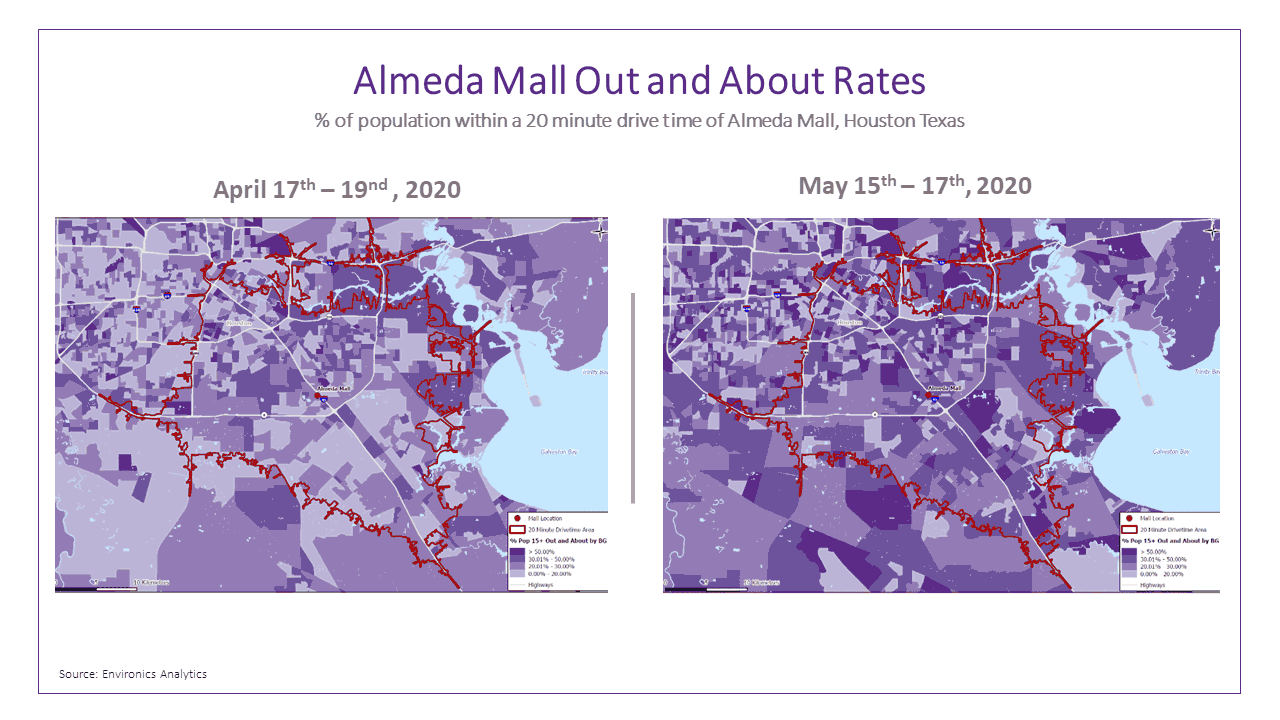

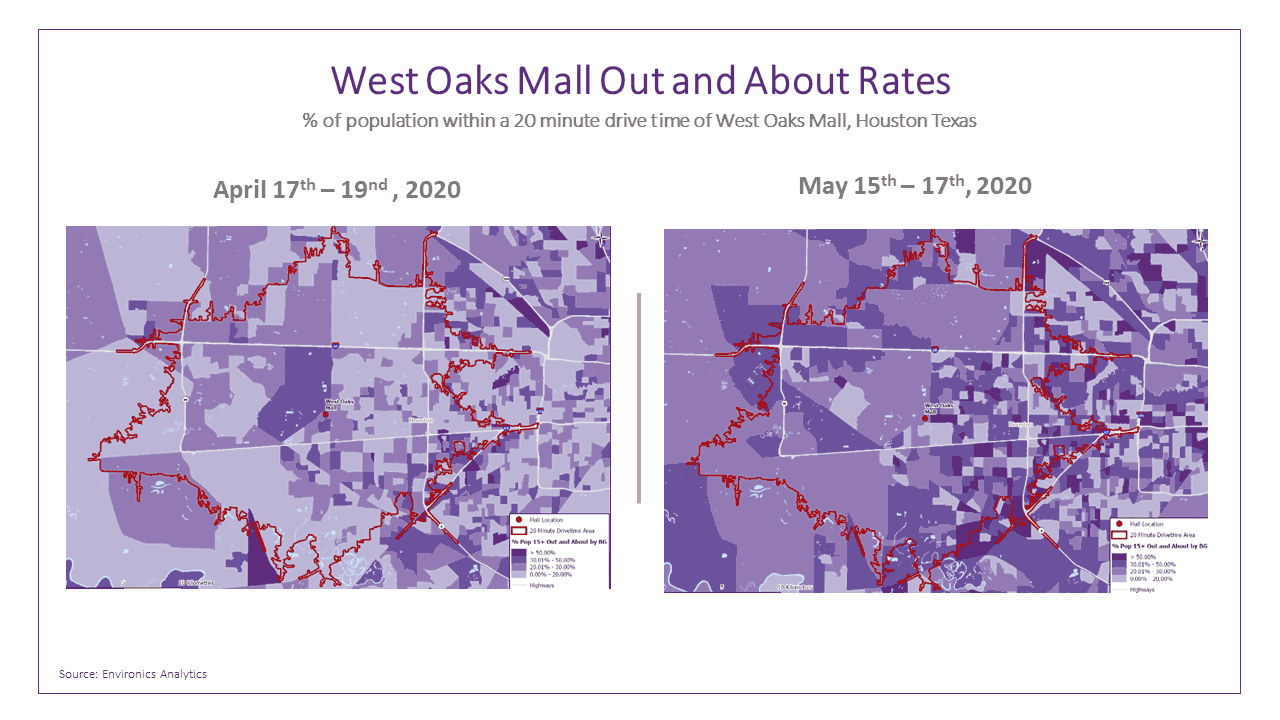

We compared a weekend in April when restrictions were in place to a weekend in May when restrictions were lifted. Within a 15-minute drive time of West Oaks Mall and Almeda Mall, we saw that about 30% of residents were out-and-about during the weekend of May 15-17 when restrictions were lifted.

When we look back at the weekend of April 17-19, the residents around West Oaks Mall were significantly less likely to have left their homes than those around Almeda Mall.

Understanding where people are out-and-about paved the way to better understand the populations around each mall and factors that contribute to higher or lower out-and-about rates over each weekend.

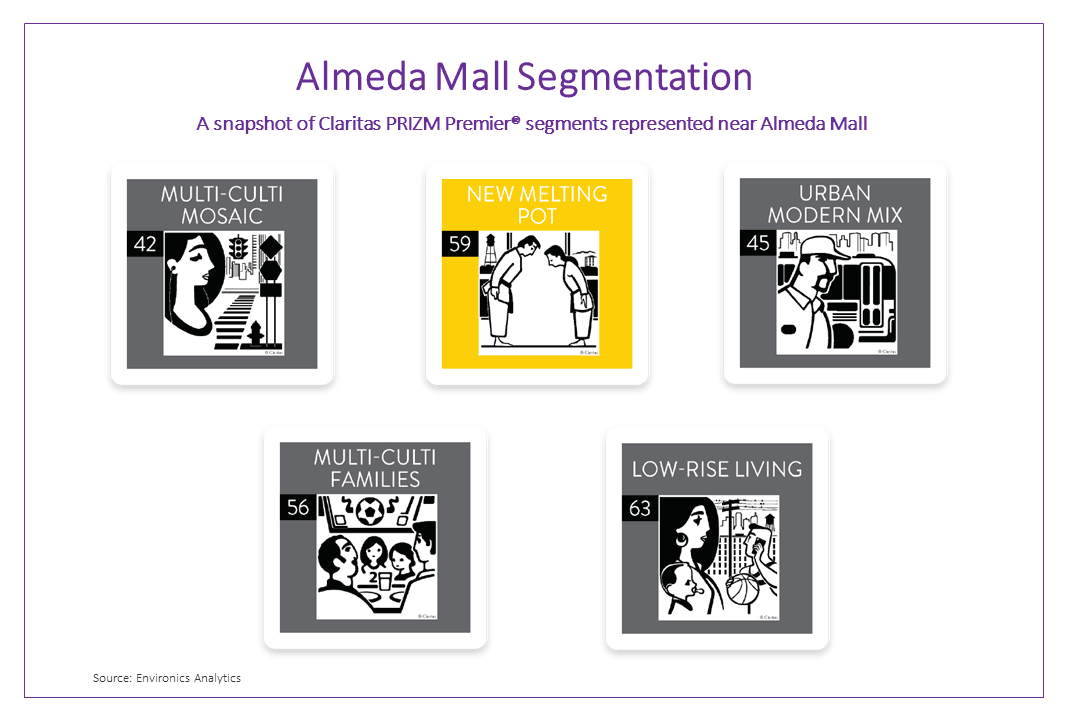

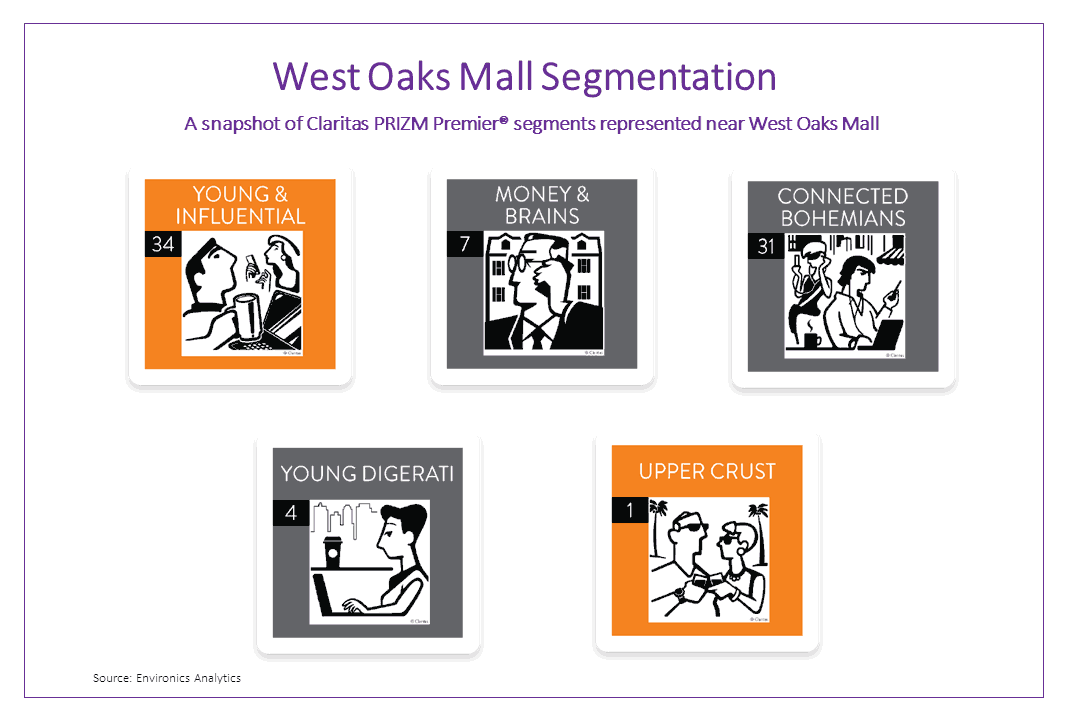

We conducted a trade area analysis using Claritas PRIZM Premier® to examine segments within a 15-minute drive time for each mall. By looking at lifestyle and behavioral segments of the populations living in nearby neighborhoods, we can dig a little bit deeper into the motivations behind going-out, or not.

Who is out-and-about near Almeda Mall?

Our trade area reporting indicated that 50% of the population around Almeda Mall works in construction, food service and healthcare industries – all sectors deemed essential during the pandemic.

This could be part of the explanation as to why a larger portion of the population around Almeda Mall was out-and-about during the April reference period, when by comparison, populations near West Oaks Mall were staying in. In the context of retail, while mobile movement data shows that these populations were and continued to be out-and-about in proximity to the mall; shopping may not be the main motivator.

Who are the people who stayed-in near West Oaks Mall during shelter-in-place?

Our trade area reporting indicated that the population near West Oaks Mall has a high concentration of younger segments who also happen to be upscale and middle-income consumers.

As restrictions lifted and people were given the okay to go-out, the out-and-about rates for this group increased. This could indicate that the consumers in the areas adjacent to West Oaks Mall may feel more comfortable going back to their regular activities like going to the mall.

Insights such as these can help retailers quantify who to talk to and what to say to drive people back to physical locations. Out-and-about data can be used to see which markets and locations, or specifically the trade areas around locations, are recovering quickest. Recovery in this instance is defined as people doing what they used to, like watching a movie, going to dinner or shopping. These insights are being used now by retailers to drive payroll and inventory type decisions.

What’s next for retailers as re-opening begins

While these times are unprecedented, they do not have to be entirely unpredictable. This is only a small sample of the data and insights available to retailers to help inform their re-opening strategy. There is no doubt that retailers have a lot on the line. The next 12 months will require them to be more data-driven to grow sales and profits and determine which stores to invest in and which to close.

Read the article, “How Data Can Breath Live into Brick and Mortar Retail”

See how we help retailers win with data and analytics.

-----

To learn more about the content of this post or to ask a question about your specific situation, get in touch. We’re ready to help.