Five Ways the 2016 Census Results Affect Marketers

Quick guide

- The consumer base grows, but growth varies across and within regions

- An aging population presents both challenges and opportunities

- The household has many versions

- Cultural diversity 2.0

- Women are an increasing economic power

Here is a look at the five biggest takeaways and what they mean for marketers.

The consumer base grows but growth varies across and within regions

The national market continues to grow at a substantial rate, but this growth varies widely across the country. The 2016 Census shows that Canada has a population of 35.2 million, up 5 percent or 1.7 million from 2011, which is slightly below the 5.9 growth rate recorded in the previous census (2006-2011).

The biggest gains can be found in Canada’s six largest urban areas. These areas, which account for close to half of the country’s population, grew by 6.9 percent over that period. The population growth rate generally slips as you look to smaller areas. For instance, the population in medium-sized urban areas (CAs or census agglomerations) increased by 3.3 percent, while rural areas grew by 1.1 percent. There were also some pockets of population decline recorded in each province. Overall, 625 of the 1,325 non-reserve rural Census Subdivisions (CSDs) with populations of at least 1,000 declined in population.

As more residents are drawn to central cities, we expect to see the increasing popularity of tech-enabled services such as online grocery stores and the proliferation of transportation alternatives like Uber, as well as other car-sharing and bicycle-sharing services. With the suburbs growing at a slower rate due to an aging population, it becomes more important for marketers to be able to identify smaller niche markets. Indeed, more retirees in these suburban and exurban areas suggest opportunities for businesses offering travel, leisure and financial services.

Although most markets will continue to experience growth, an increasing part of rural and small urban Canada will need to plan for population declines and an aging population. Businesses will need to adjust their product offerings and governments may face challenges in maintaining emergency services, health care and social services like libraries and schools.

Marketers will also want to pay close attention to immigration trends. About two-thirds of Canada’s population growth can be attributed to immigration. Immigration in the coming years is expected to be higher than in the past and many areas of the country that have not been traditional immigrant destinations will be looking to attract and retain newcomers. This will provide marketers with opportunities to create new relationships with first-mover advantages.

An aging population presents both challenges and opportunities

Today, marketers are heavily focused on the young Millennial generation aged 23-38 in 2018. This generation is transitioning from living at home and attending school to moving out on their own, finding full time employment and starting families of their own. Over the coming years this generation will be an increasingly important consumer group as their spending power increases. However the older generation, increasingly dominated by Boomers should not be forgotten by marketers.

Given Canada’s fertility rate has been low since the mid-1960s, we’ve known for many decades that the country’s population will continue to get older. We crossed an important threshold in 2016. For the time there were more seniors (65 and older) than children (0-14 years old). Half the population is now over the age of 40. According to the 2016 Census, 16.6 percent of the population was under the age of 15, while 16.9 percent of the population was age 65 or older in 2016, which was more than twice the percentage in 1961 (7.6 percent). In about 20 years about one in four Canadians is expected to be over the age of 65, while the population under age 15 will remain close to 15 percent.

Historically, the largest metropolitan areas were home to an older population than the suburbs, but the 2016 Census shows that the age gap between central city and suburbs has virtually closed, or in the case in Montreal and Vancouver started to reverse. In Toronto, the suburban senior population increased by 31 percent, compared to 13 percent for the city; in Montreal, the difference was 23 percent versus 9 percent, and in Vancouver, 25 percent versus 19 percent.

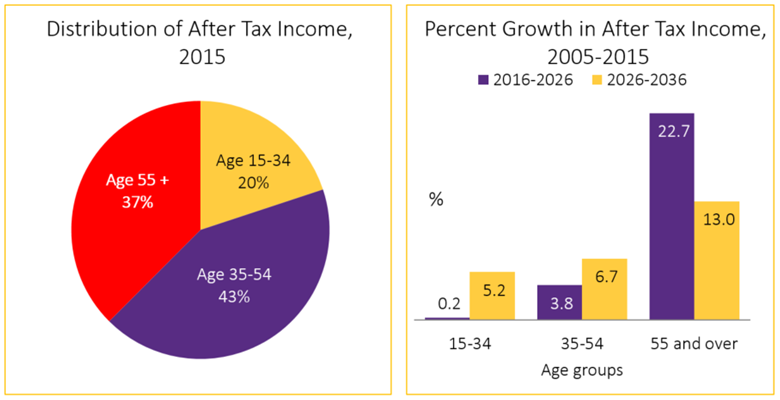

Over the next decade Canada’s older population aged 55 and over is expected to grow by about 40 percent compared to a growth of only 4 percent for the population under age 55. Today the population aged 55 and over accounts for close to 40 percent of total spending power and so the aggregate spending of the older population will greatly increase over the next decade.

The Older population has high growth that will result in a big increase in spending power

The large and rapidly growing older population offers the potential for businesses and industries to market existing products or design new products for this growing population. The older population may have a particular impact on industries, such as health care including home care, travel and financial services.

There will also be implications for the home building and renovation industries. As Boomers approach their mid-seventies, they’ll likely begin downsizing, resulting in an increased interest in apartment living—including both condos and rental apartments. Assisted living residences for seniors will also likely attract increased attention as health problems become more common among aging Canadians and their ability to live independently wanes. The demand for more intensive care in nursing homes is also expected to soar when the large Boomer cohort moves into their 80s.

At a more micro level, governments will be faced with providing increased services to the older population. And while many seniors will have considerable incomes and wealth, a particularly vulnerable group may be those seniors living on the own. Between 2005 and 2015, the low income rate for seniors increased from 12 percent to 14.5 percent and in 2015 one third of seniors living alone were in a low income situation. Given the forthcoming large increases in the seniors’ population, many more seniors will be in need of affordable housing and income support.

The household has many versions

The aging of the population means that the population is slowly declining in many neighbourhoods of central cities and older suburbs. In 2016, slightly more than 60 percent of all households have only one or two people.

Couples with children at home account for about one quarter of all households but their numbers increased by only 1.5 percent over the period 2011-2016. About nine percent of households were lone parent households and close to five percent of more complex households also have children at home. In other words, less than 40 percent of all households have children at home. Single person households account for over a quarter of all households and their numbers increased by 8.1 percent over the period 2011-2016, while couples without children also account for about a quarter of households and increased by 6.9 percent. Overall, the fastest growth was for multigenerational households due to the relatively high levels of immigration.

A diversity of households

Clearly, the nuclear family no longer dominates the Canadian household landscape, and marketers should be sensitive to the new dynamics at play. The shifting make-up of households means that the demand for products and services will also shift. Smaller and older households also have implications for packaging size as well as the labelling of products.

Cultural diversity 2.0

The 2016 Census reported that there were 7.5 million immigrants in Canada. This means that immigrants represent 21.9 percent of the country’s total population—the highest proportion of foreign-born found in any census since Confederation, except one (1921). Today’s immigrant population is diverse, including new arrivals and long-settled individuals and families.

More than a third of immigrants (37.8 percent) have been in Canada for more than 25 years, while 16 percent (1.2 million) arrived between 2011 and 2016. Between 2011 and 2016, 62 percent of immigrants were from Asia and only 12 percent from Europe. In fact, during that five-year period something notable happened for the first time: more immigrants arrived from Africa (13 percent) than from Europe. Other source areas were South and Central America and the Caribbean (10 percent), and the United States and Oceania (3 percent).

In 2006, half of all immigrants to Canada settled in Ontario and an additional 17 percent in each of British Columbia and Quebec. In other words, only 15 percent of immigrants chose the rest of Canada—where 25 percent of settled Canadians lived. Over the last decade this pattern has changed. In 2016, the share of immigrants going to Ontario dropped to 38 percent, while the shares going to British Columbia and Quebec remained stable.

Ontario’s loss was other provinces’ gain: collectively, the other seven provinces doubled their share of immigrants, from 15 to 30 percent. The Atlantic region and Alberta more than doubled their intake of immigrants, while Manitoba’s intake increased by close to 50 percent. In 2013, Alberta surpassed British Columbia in the number of immigrants it received. But the most dramatic increase over the last decade happened in Saskatchewan, where immigration increased from 2,700 in 2006 to almost 15,000 in 2016.

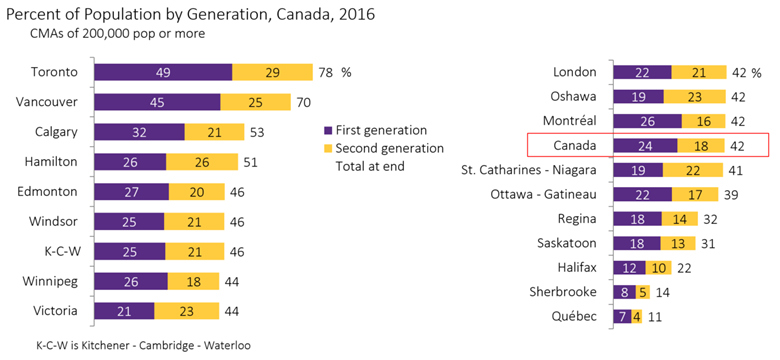

Most immigrants settle in Canada’s large urban areas. Between 2011 and 2016, nearly three quarters of all immigrants settled in Canada’s six largest metropolitan areas, which together are home to half of Canada’s total population. The concentration of immigrants in big cities varies widely; it’s highest in Toronto (46 percent), followed by Vancouver (41 percent) and Calgary (29 percent). In fact in 2016, immigrants and their children (second generation) accounted for 78 percent of the population of the Toronto CMA and 70 percent of the population of the Vancouver CMA.

Nearly 80% of the Toronto CMA are first or second generation

Overall, in 2016 the visible minority population accounted for 22.3 percent of the total population. However, as with immigrants, concentrations varied widely. In fact, in the Toronto and Vancouver CMAs, the visible minority population is now the majority, accounting for just over half the total population. Indeed, in 2016 there were 12 large municipalities around Toronto and Vancouver where the collective visible minority population represented a majority. The highest concentrations were in Markham, Ontario (78 percent) and Richmond, B.C. (76 percent).

Within the visible minority population there is much diversity not only by country of origin, but also by generation. Overall, just over two-thirds of the visible minority population are immigrants and an additional 28 percent are second generation, the children of immigrants. The second generation are very young on average. About half are under the age of 15 and an additional 38 percent are aged 15-34.

This young, second generation, visible minority population are likely to have very different values and consumer preferences from their parents, a fact that any marketing and communications effort should take into account. Indeed, some argue that as the visible minority population grows targeting specific ethnic groups may no longer be necessary: diversity is the new norm, and almost everyone (including non-visible minority Canadians) is influenced by it.

As with other demographic factors, it’s important to recognize that the mix of visible minority groups varies widely across the country. Businesses need to understand the make-up of the population in their own trade or service area. For example, in Toronto, the three largest visible minority groups are South Asian, Chinese, and Black. In Montreal, the three largest are Black, Arab, and Latin American. In Winnipeg, the top three are Filipino, South Asian, and Black.

Recently, the Federal government announced increased immigration targets for the next three years. Perhaps not surprisingly, virtually all further population growth will be accounted for by immigrants or the children of immigrants. Recent projections by Statistics Canada suggest that if recent trends continue, the percent of immigrants will increase from 22 percent to close to 30 percent in another 20 years.

The visible minority population will increase even more, reaching close to 35 percent of the total population when we take into account both continued new arrivals and a large and growing second generation. Across the county, these projections indicate that by 2036 the visible minority population will account for about two-thirds of the population of the Toronto and Vancouver CMAs, and half the population of Calgary. In another 13 metropolitan areas the visible minority population will account for at least a quarter of the total population.

With Canada’s population drawn from many parts of the world, marketers need to understand how the needs and preferences of consumers vary. The way consumers hear and interpret messages may be shaped by their past, and marketers will need to consider these influences when developing promotion campaigns.

Although increasingly businesses want to connect with the new market, this fast-growing, diverse population presents marketers with a number of challenges. A first challenge involves understanding the extent to which your current customer base includes various visible minority communities. As diversity spreads out from the traditional markets of Toronto, Vancouver and Montreal, attention needs to be given to other urban areas with growing immigrant groups.

Another challenge for businesses is defining the target population of interest. The census provides a rich source of data on the diverse Canadian population. Information is available on each of the visible minority groups, but as discussed above, there’s also diversity within these groups. For example, marketers must decide on whether to focus on the entire group or only more recent immigrants. Should the second generation be included? Should temporary residents be included?

Even within a visible minority group, marketers must determine what target population they want to engage. Is a broad category, such as South Asian or Latin American consumers, sufficient or do marketers need to further divide a group in terms of countries or languages of origin? Should they focus separately on the Chinese populations from Hong Kong and China or those that speak Mandarin or Cantonese? The decision on what groups to focus on depends in part on the extent to which factors such as values, media and consumer behaviour are distinct.

Another important question concerns which language to use when communicating messages and placing ads in so-called ethnic media. The Census provides data on a number of different language dimensions, including mother tongue, language spoken most often at home, other languages spoken regularly at home and knowledge of languages. And marketers should keep in mind that knowledge and use of English and French vary widely in these groups. A related question for consideration is the extent to which various groups consume ethnic media. Clearly, increasing diversity presents both opportunities and challenges for marketers.

Women are an increasing economic power

Women have long been an important focus for marketers and the 2016 Census points to the increasing economic power of women. In part this is due to the long term trend of increasing female labour force participation. And marketers need to be aware that the female consumer of today is very different from her mother and grandmother.

At younger ages, women are now much more educated the males. In 2016, 74 percent of women under the age of 45 had a postsecondary degree or diploma compared to 65 percent of males. This difference is reflected in the fact that young Millennial women aged 25-34 are now a majority of young workers in many professions including family and specialist physicians, lawyers, dentists, architects, and many others.

Major gains in female representation in many professions

Although there remains a gap in male-female earnings, the gap closed somewhat between 2005 and 2015 as women’s employment income increases were higher than for men. Moreover in 2016, in about one-third of couples, incomes were fairly equal (both earning from 40 percent to 60 percent of the couple’s total income) while in 17.3 percent, women had relatively higher income.

At ages 25-64 approximately one in three women (6.2 million) are not married or in a common law union. These women, most never married or divorced or separated, are either lone parents or live either alone or with others.

As a result of the fact that the life expectancy of women exceeds that of men coupled with the fact that many women marry men older than themselves, in 2016 one third of all women aged 65 and over and 43 percent of those 75 and over living in private households lived alone. The future high growth of the older population means that going forward there will be a substantial increase in the number of older baby boom women living on their own.

Women of all ages need to be an increasing focus of marketers. Young women with increased spending power will look for ways of better balancing work and family pressures but will also be looking to spend on themselves. In the mid age years 25-64, over one third are either lone parents or are living in a non-family environment.

These women have considerable spending power. And the large group of older Baby Boom women are a new breed of older female consumers. They are well educated, many having been in the labour force, and now with increased leisure time in an empty nest or solo living environment, they are looking for experiences and products that they could not afford while bringing up their children.

Doug Norris, Ph.D., is a Senior Vice President and Chief Demographer at Environics Analytics and one of Canada’s leading experts on the census.