Are consumers in Quebec really that different?

While working on a recent project for a retailer in Quebec I was suddenly reminded of the 2007 film Bon Cop, Bad Cop. The buddy-comedy playfully riffs off the linguistic and cultural stereotypes between Ontario and Quebec. The film portrays the Ontario detective as a by-the-book stiff, while the Quebec inspector is depicted a brash chain-smoking rogue willing to bend the rules to close the case. While both detectives are fully-bilingual, they have trouble communicating, rarely see eye to eye and seem completely out of place when away from their home turf.

Just as this film reminds us that the differences between the two provinces transcend language, studying the merchandise mix, values, demographics and spending patterns for this retailer reinforces the notion that consumers in Quebec and Ontario see things differently. Political preferences, lifestyle, family dynamics and humour between the two provinces may look similar from afar, but they are slightly incongruous when viewed up close. Simply understanding the language doesn’t mean you can understand the nuances that make Quebec and Ontario distinct.

So, how does Quebec differ from Ontario and what does this mean for retailers, marketers and hiring managers? Let’s look at the differences through the lens of a fictional consumer we’ll call Natalie.

Who is Natalie?

Natalie represents the average customer in Quebec. She is 29 and speaks French at home with her partner Jean. Together their household income is two thirds of what the average Ontario household takes home each year. Her circle of friends is fairly homogenous, mirroring the lower levels of diversity in the province. The visible minorities she most often associates with identify as either black, Latin American or Arab. On a visit to Ontario, however, she is reminded of the greater presence of visible minorities in that province, particularly given its much larger populations of Chinese and South Asian residents.

Natalie seeks authenticity in her professional and personal life. She pursues work that she finds fulfilling and allows her to discover and preserve the cultural heritage and customs of her family. She also values nature and is concerned about how industrial and broad public indifference are impacting the environment.

When it comes to consumption, she is not motivated by brand loyalty. For Natalie, shopping is an emotional experience rather than one driven by a practical or logical need. As a result, she tends to shy away from big box stores, which she finds sterile and impersonal. Instead she favours independent boutiques for clothes and prefers home-grown chains like Jean Coutu and Provigo for her staples.

Both Natalie and her family’s love of the outdoors is also reflected in their purchases. Last year, her parents purchased an ATV and installed a pool and hot tub. Next year, Natalie plans on purchasing ski and snowboard equipment so that she can enjoy being out in nature all year round. The cold winter is not a disincentive to enjoying the outdoors.

While Natalie is not prone to shopping online because she feels it takes away from the tactile experience of shopping she enjoys, she might make an exception for Boutique 1861. The one-of-a-kind clothing shop does an effective job of blending the brick and mortar store experience with its online store to ensure she has a fun and pleasurable shopping experience. She appreciates being able to see what other customers recently purchased and seeing the total number of each item available for sale to create the feeling that she is purchasing something unique. Even the way it arrives at her door makes her purchases feel special. Every order is delivered in whimsical packaging sprayed with perfume and includes a note from the craftsperson who made the item.

Applying market level knowledge for actionable insights

The fictional consumer Natalie brings to light some actionable marketing implications as a result of differences in mindset, demographics and retail preferences across provinces. Knowing how customers differ between provinces is an essential starting point for expanding and succeeding in Quebec.

Here are some examples of the high level differences between Quebec and Ontario.

Top SocialValues in Ontario versus Quebec

| Quebec | Ontario |

|---|---|

| Fulfilment through work | Culture sampling |

| Brand apathy | Need for escape |

| Joy of consumption | Multiculturalism |

| Pursuit of intensity | North American dream |

| Ecological concern | Status via home |

High indexing store types in Ontario versus Quebec

| Quebec | Ontario |

|---|---|

| Kitchen stores | Factory outlet stores/malls |

| Stand-alone boutique shops | Bulk food stores |

| Fashion accessories stores | Natural/health food stores |

High indexing retailers in Ontario and Quebec

| Quebec | Ontario |

|---|---|

| Sports Experts | Pet Valu |

| BMR | Lowe’s Home Improvement |

| Globo | Mastermind |

| Atmosphere | Roots |

| Book stores (other) | Leon’s |

The second step is knowing more about the local markets and customers you are targeting, and how your sales associates can best reach those audiences. Just at these data can show the differences between provinces, these same data points also be captured at a postal code level to understand your customers and how they differ from the average within a province. This level of detail would allow you to understand how a consumer like Natalie living in Montreal might differ or resemble a Natalie living in Quebec City.

For marketers – customer segmentation

As Natalie shows us, consumption in Quebec is often motivated by the gratification consumers feel when shopping, which makes delivering a personalized customer experience even more important in that province. While Quebec consumers are generally driven more by emotion and the joy of consumption, organizations need to be aware that there is diversity within the province which can lead to more meaningful and targeted insights. The customer experience needs to reflect the demographics, values and buying power of each segment of the Quebec population. Is it a young, price conscious segment that values challenging the status quo? Or is it an older segment that wants to protect Quebec’s distinct cultural roots and is hesitant to change?

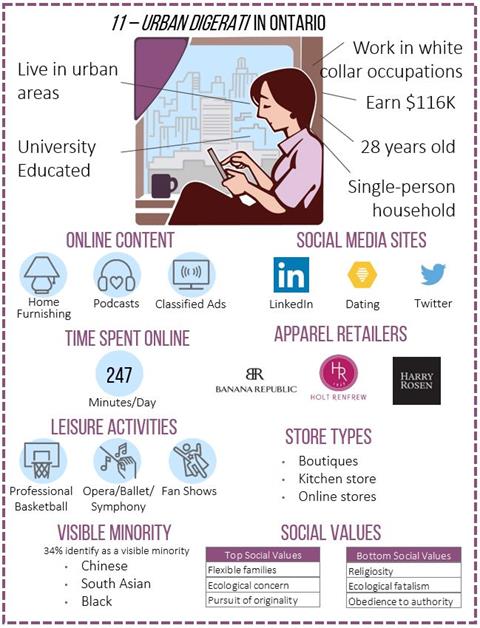

PRIZM5 Comparison of Preferences and Demographics of Young Segments in Ontario and Quebec

| Urban Digerati in Ontario | Jeunes et Actifs in Quebec |

|---|---|

|

|

Sources: PRIZM5 2017, Opticks Numeris RTS, DemoStats 2017, SocialValues, Opticks Vividata

For Hiring Managers

In order to connect with Natalie and deliver the customer experience she craves, retailers need to hire the right sales associates. A recent project for a furniture retailer illustrated that knowing more about your associates’ lifestyle types and values could reveal many actionable insights for hiring managers. Hiring managers can think about aligning their associates’ PRIZM5 profiles with their customers, investigating their associates’ demographics and SocialValues to understand what motivates them, and using other data to understand questions around retention and performance. For example, our SocialValues database can lend insights into what sorts of employee reward programs would be most meaningful for local employees.

Moreover, educating associates about customer segments in the local market and what they might like or need can also enhance the local customer experience, since they’ll be more prepared to personalize their experience and adapt their sales techniques based on whether a customer is likely to be more price conscious or more utilitarian in their consumption habits. Through our ENVISION platform’s dashboard trade area reports, retailers can gain access to information about the mindsets, demographics, and preferences of customers within their store trade area(s). Local managers can think about how best to share these data driven customer insights with associates, in order to develop deeper customer relationships and enhance the in-store experience. Equipped with information about customers, associates can then move from viewing consumers purely as customers and more as relationships they are investing in.

We can help you understand your segments, build real estate models, or help you understand, educate, and align your sales associates to help develop a successful expansion strategy. When we dive into differences at a more local/regional level, these differences become more pronounced and comparisons within Quebec yield greater insights. And it is this local understanding, and the ability to carve out a local niche, which are key to succeeding in the Quebec market and enhancing the local customer experience.

Louise Willard is a Client Advocate with Environics Analytics