Injecting Data: Who is the Medical Aesthetics Consumer in Canada?

The Canadian medical aesthetics market is large and growing rapidly, and there are specific types of consumers that may surprise you.

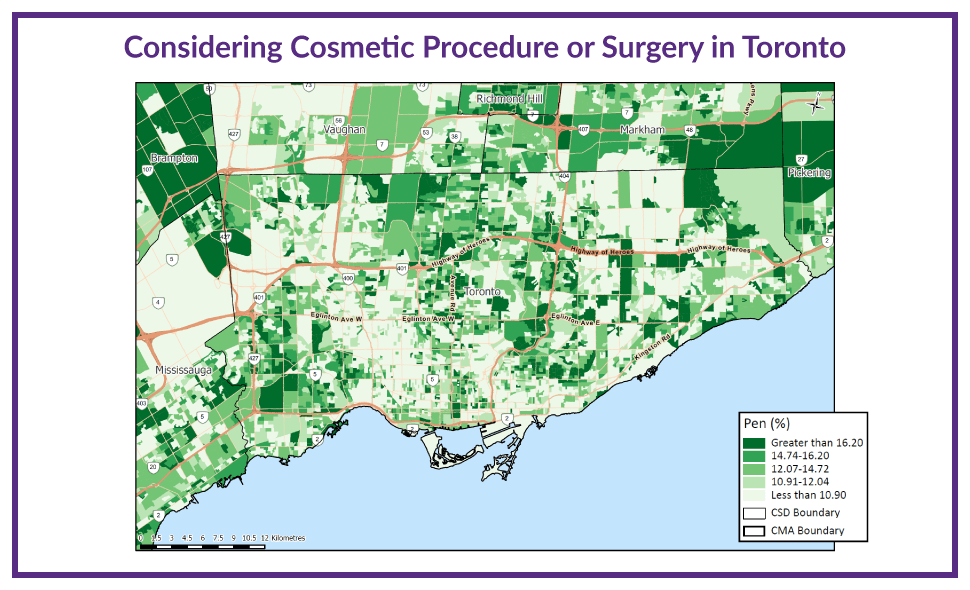

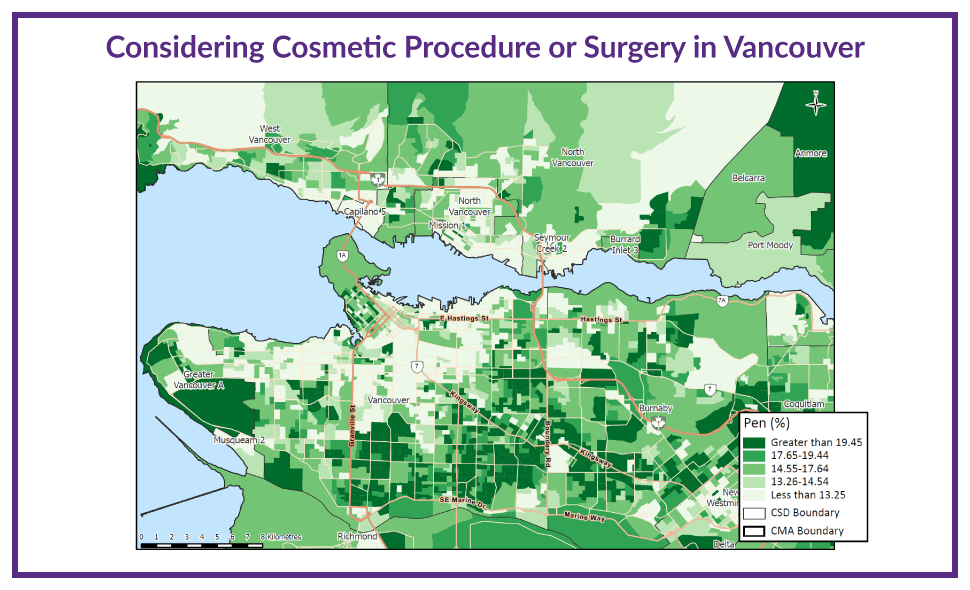

According to Environics Analytics’ (EA) research conducted across the Toronto and Vancouver markets, leveraging PRIZM® segmentation data, estimates show over 2.5 million people fit the consumer profile that are likely to receive medical aesthetics procedures in these markets. These non-invasive procedures include injectables to combat aging and wrinkles, and dermal filler procedures to restore facial volume for a more youthful appearance and body contouring treatments to remove excess fat.

But who is the target consumer for these types of procedures? Some may think of a middle-aged woman who earns an above-average income. This is indeed a major target demographic, but are there others?

This analysis shows that a significant number of young adults between the ages of 18-29 are likely to receive medical aesthetics treatments across both the Toronto and Vancouver markets. The Toronto market also shows that mature consumers in their 60’s and well into their 70’s are obtaining these services at higher-than-average rates. Overall, consumers are age-diverse and almost twice as likely to be from different ethnic groups.

What’s perhaps most surprising, due to the high costs of keeping up with treatments throughout the year, is the socioeconomic status of the medical aesthetics consumer.

Research shows that individuals amongst some of the lowest socioeconomic standings in the country, earning on average 35% below the Canadian average, are still highly likely to receive these services despite the costs. Why is this? What is driving these individuals to potentially prioritize their appearance over other necessities?

Let’s take a closer look at the younger, low-income earners, aged 18-29 in the Toronto and Vancouver markets to better understand who they are and what motivates them. This demographic is often employed in the food service sector, likely working in food/bar service with some being university educated while others have earned a trade certificate. When not at work, these individuals tend to shop for clothing at stores like Zara and enjoy the feeling of buying things they don’t necessarily need, often only paying the monthly minimum towards their credit card bill. They are actively social and enjoy frequenting bars and nightclubs with friends before returning home to their walk-up apartment to spend the rest of the night scrolling social media sites.

Diving deeper into available psychographic data, research shows this demographic tends to place a lot of importance on aesthetics, enjoy being considered attractive to others and take a lot of pleasure in looking after their appearance.

Behaviour data suggest this younger group is also interested in more advanced cosmetic surgery at above-average rates compared to the rest of Canada. They claim to be open to more extensive and invasive permanent procedures to improve their appearance. Many have recently visited a cosmetic surgeon or plan to do so in the near future. This sentiment was compared to consumers earning above-average incomes across all ages and found to not be a shared mindset with this group.

When considering this younger group’s attitude and behaviours toward their overall health, they tend to be on the lower end of the spectrum. They may be looking more for a “quick fix” and the instant gratification of improving their appearance rather than putting in the required time to accomplish the desired results through a well-balanced, healthy lifestyle.

How can marketers reach these young consumers in the growing marketplace to gain and establish market share? It’s possible by leveraging actionable data—and we’ve only scratched the surface of what can be learned about this group.

Data, analytics and insights can help uncover a multitude of answers for informed decision-making to help businesses achieve their goals, providing crucial answers to questions like:

- Who is the medical aesthetic consumer in other markets?

- Are they similar to those in Vancouver and Toronto or are they completely different?

- What attitudes and mindsets do they have that marketers can leverage to communicate to them?

- What media channels do they consume and where are they located?

- Where is there untapped potential?

- How does the market differ based on gender?

- What drives the mature consumer earning below-average incomes to seek these treatments?

Many would be partially correct in their initial assumption about the medical aesthetics consumer market, but there’s more to the story. There’s more to uncover about who the assumed consumer is and how to best reach them. But equally, there is more to learn about other emerging consumer groups who are receiving medical aesthetics procedures at increasing rates.

Get in touch to learn how you can leverage data and analytics for your medical aesthetics brand.

Related Content

* PRIZM® is a registered trademark of Claritas, LLC.