WealthCare

A data-driven solution to measure financial wellness

WealthCare is a proprietary scoring system, comprised of over 100 variables, to measure the financial wellness of your customers by evaluating their lifestage, financial behaviours and attitudes across four key dimensions: Spending, Leverage, Planning and Financial Acumen.

Financial institutions, government and non-profit organizations use WealthCare to provide an overall indicator of financial wellness, by age, to help identify the challenges and opportunities their customers, members or donors are likely to experience. This

approach provides the intelligence needed to engage and support your customers, donors or members in more relevant and meaningful ways.

Find households most vulnerable to financial instability

Understand the effects of the pandemic on the overall financial wellness of your customers

Differentiate your offerings from the competition

Offer relevant advice and programs

Meet the financial needs of your customers and members

Reflect the economic conditions to retain or grow your client base

Measure Financial Wellness Across Four Key Dimensions

The overall WealthCare score is comprised of four component grades that measure financial wellness based on over 100 variables spanning across 10 data sources including financial holdings, spending patterns, social values and attitudes related to financial health in Canada.

Spending

Determines the likelihood of your customers living within their means

Leverage

Evaluates whether your customers have a balanced relationship between assets and debt

Planning

Assesses whether households are making their financial future a priority

Financial Acumen

Analyzes to what degree households self-invest, seek advice or hold a diversity of investments

Ready to turn data into actionable insights for your business?

We can help.

Check the Financial Pulse of Your Customers

Assess and address the financial vulnerability of your customers, citizens and members during these turbulent times. WealthCare helps you evaluate the economic impact on your customers and markets so you can adapt business needs and optimize resources.

Find release notes, score range glossary and more information about how to use WealthCare on our Community website.

Evaluate the Financial Behaviours and Attitudes of Canadians

Households with the same incomes and wealth can approach their finances in very different ways. WealthCare helps marketers and analysts understand what factors significantly influence Canadians' financial decisions. Gain a deeper understanding of your customers' spending habits and financial knowledge to inform your service and product offerings.

Use WealthCare to identify:

- Which customers are most at risk and which ones are more prepared to weather a storm

- Customers who are most vulnerable with little savings to bridge a financial downturn or those who have assets to leverage and need advice on debt financing

- Opportunities for financial assistance or full-service advice

- Opportunities to improve financial wellness and put customers at ease

Webinar: The Financial State of Canadians

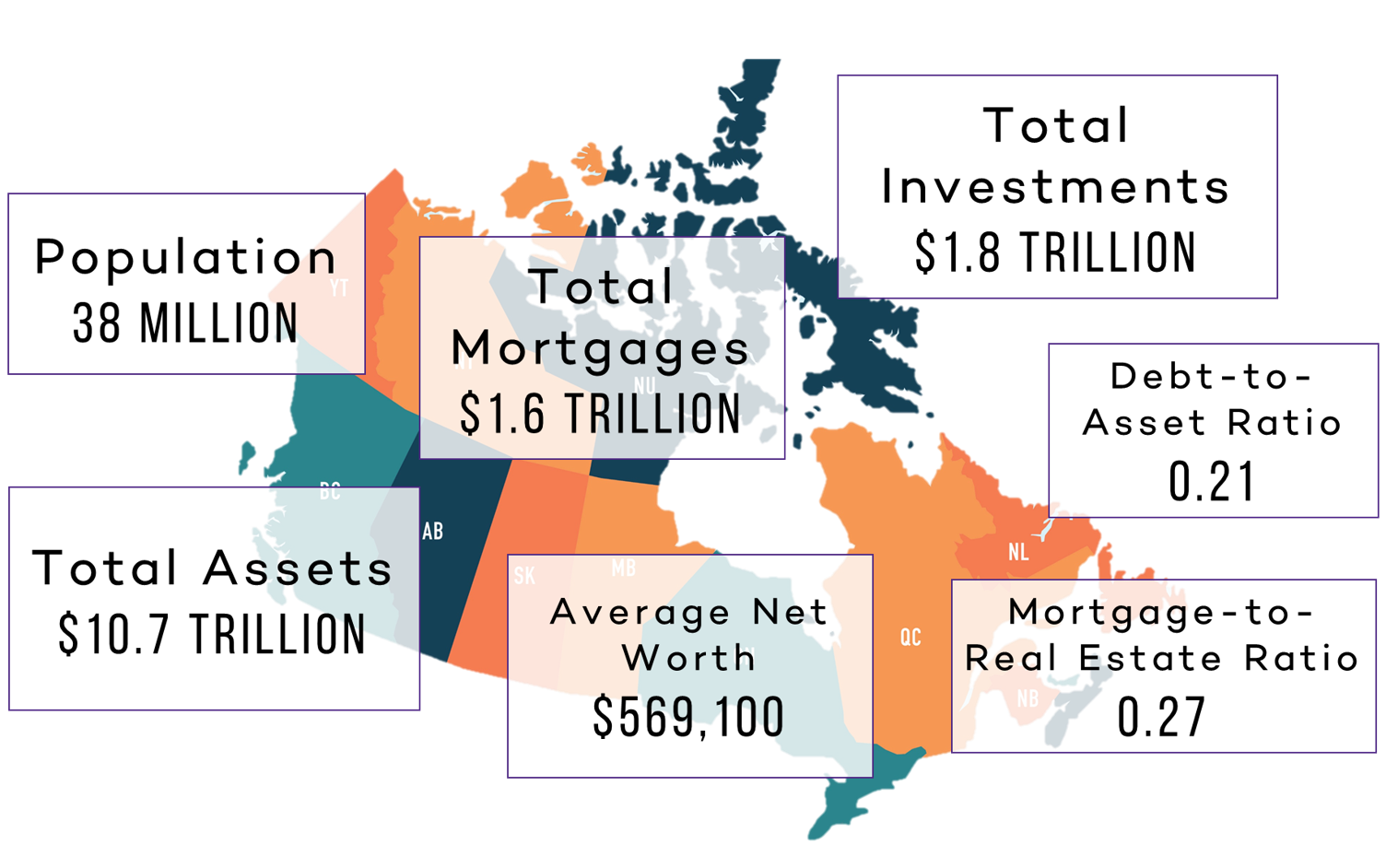

Learn from our experts about current trends in assets, liabilities and income of Canadians and find out why powerful insights generated from the WealthScapes database are an essential resource for any organization looking to gain a better understanding of the financial and investment behaviours of their market.

Environics Analytics Webinar Series

Register for upcoming webinars or access our past presentations.

Keep up to date on the latest trends and discover the latest advancements in our data and analytics services and product offerings.

More Data to Choose From

Enhance your understanding of the financial behaviours of Canadians and develop a comprehensive picture of their assets, liabilities and net worth.

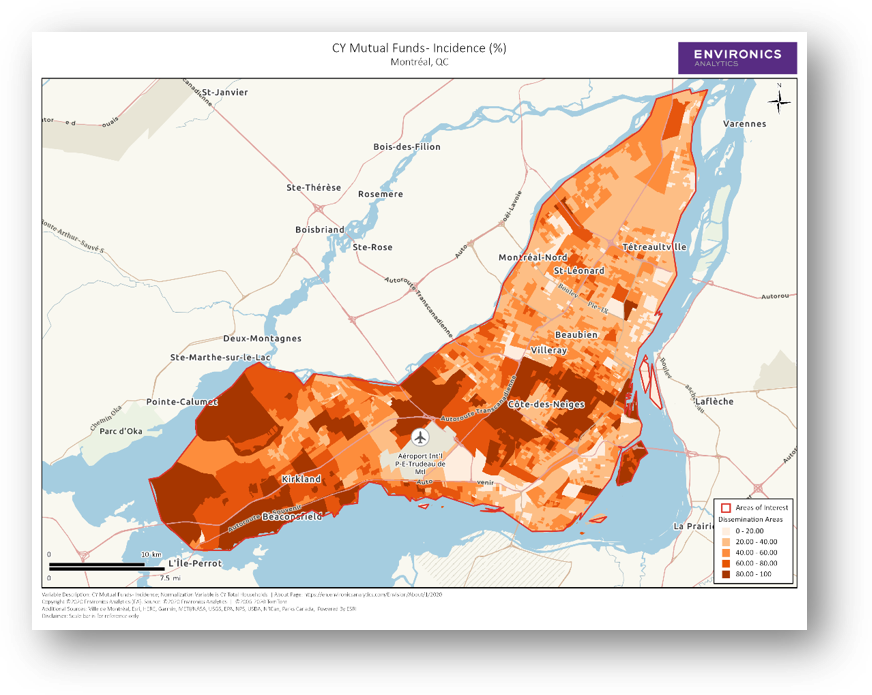

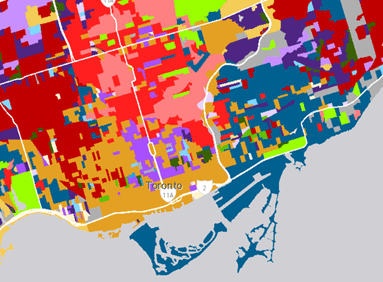

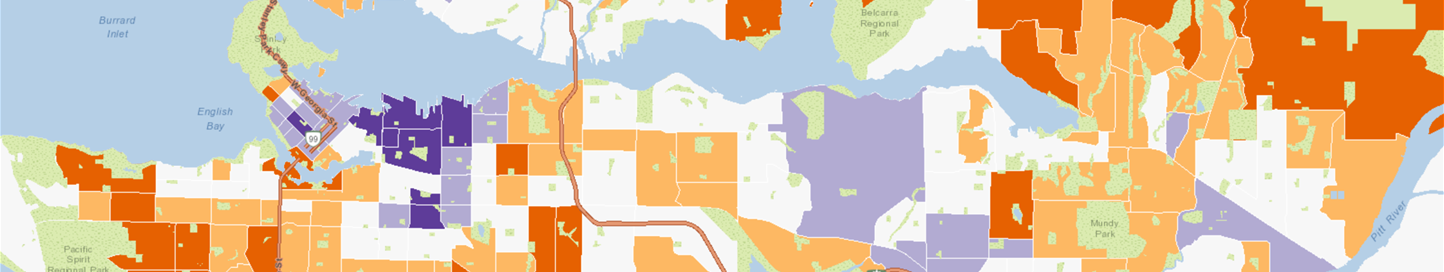

PRIZM segmentation classifies Canadians into 67 unique lifestyle types to help you better analyze and understand your prospects and customers.

The FVI helps government, social services and private industry sectors to understand the populations most at risk financially during the COVID-19 pandemic.

A comprehensive database for information on the assets, liabilities and income of Canadians and designed for financial planning, marketing and targeting applications.

Identify prospective donors that are likely to receive an inheritance and potentially a greater capacity to donate.